What to Build When Everything Becomes a Casino

I’ve been watching something strange unfold over the past two years, and I can’t shake the feeling that we’re living through a cultural inflection point that most people haven’t fully processed yet.

Memes are now tradable assets with eight-figure market caps. Prediction markets surged to $13-15 billion in annual trading volume by late 2025, up from just $100 million in early 2024. “Vibe coding” platforms like Replit are selling the dream that anyone can build the next Silicon Valley unicorn through natural language prompts. Your college roommate is selling a testosterone optimization course from a rented Lamborghini. The kid who barely passed economics is running a peptide protocol coaching empire promising fitness results “without the effort.”

This isn’t just “late-stage capitalism” social media discourse. Something deeper is happening. The question that keeps me up at night isn’t whether everything is becoming financialized the data confirms it already has. The question is: what does this tell us about where we are as a culture, and what should we actually do about it?

Three Forces that Will Define 2026 and Beyond

1) “Secure the Bag” Before AGI

Some think we’re 2-5 years away from AGI, others think it’ll take decades. Whether or not this timeline is accurate matters less than the behavioral shifts it’s producing.

I’m seeing incredibly talented people abandon skill development for “bag securing.” The logic is simple, if brutal: why spend five years mastering a craft when AI might do it better in three? Better to extract maximum value from the current system before it fundamentally restructures. In some ways, this is very logical.

You can see this urgency playing out everywhere. The meme coin market crashed from peaks around $87 billion in trading volume, only to be replaced by prediction markets like Kalshi and Polymarket. Same mechanics, different wrapper. Insider groups profiting early, retail making money initially, then losing it all. The cycle is repeating.

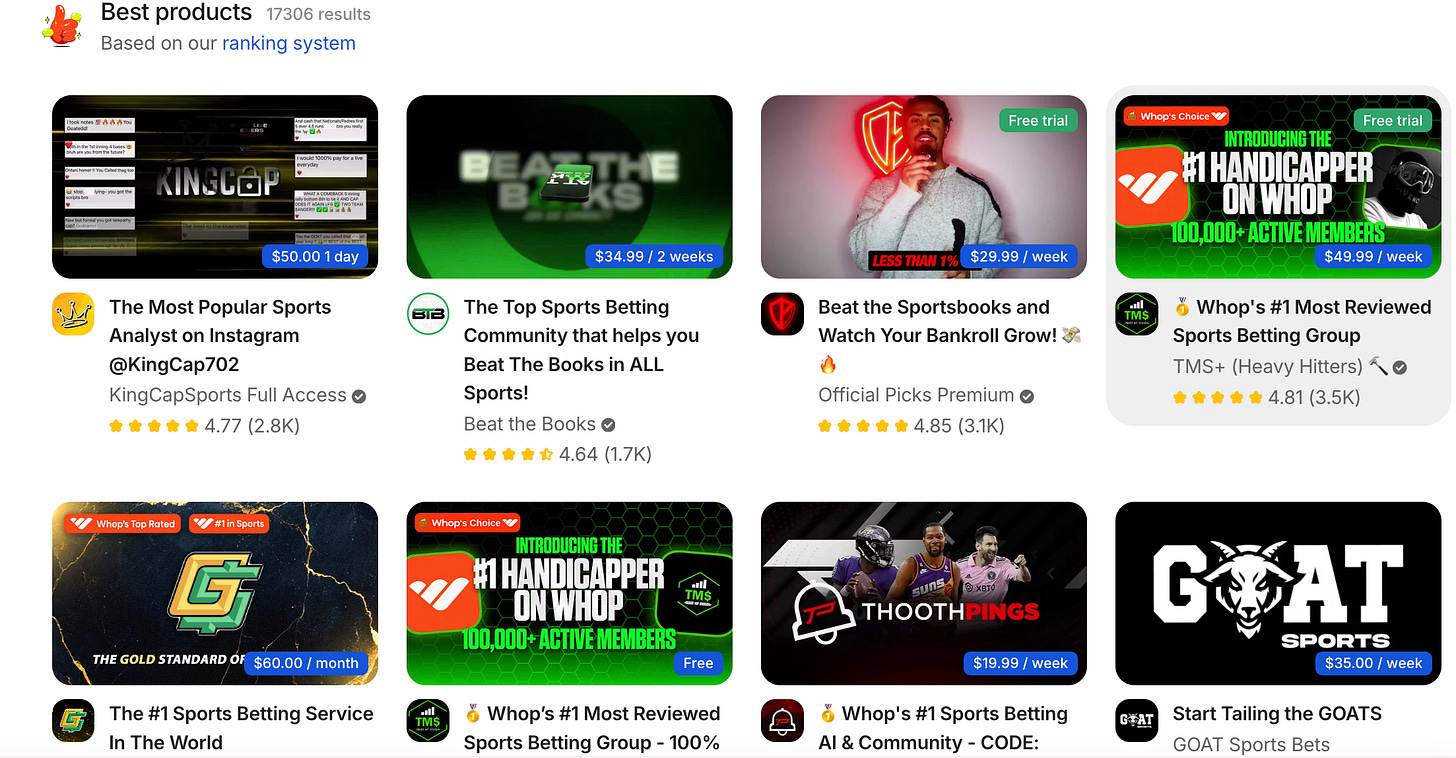

What people often don’t realize is that the biggest earners aren’t necessarily traders, but affiliate code peddlers. The memecoin insider groups of yesterday are now repackaged as prediction market Discord servers and betting tip groups.

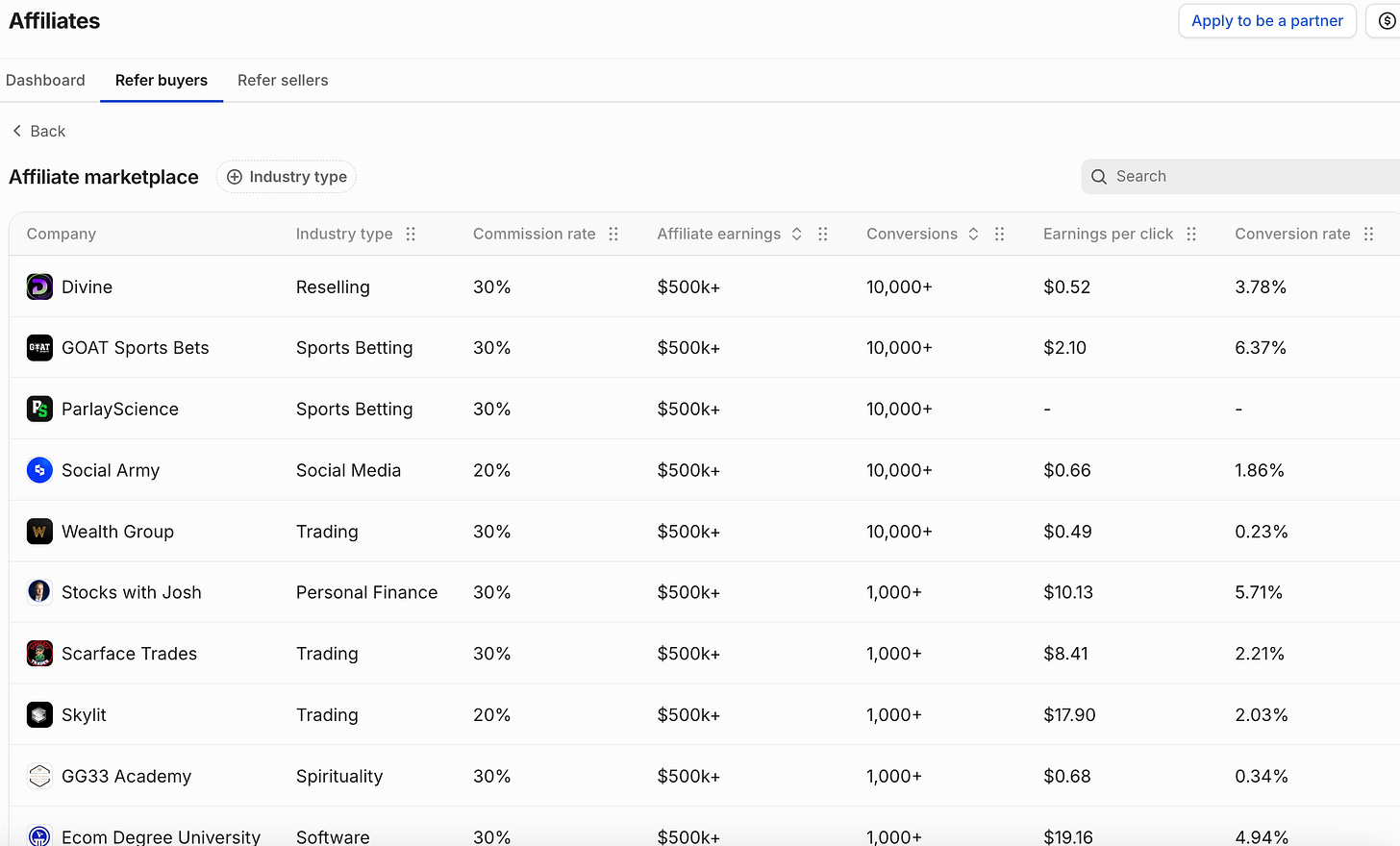

How are these groups able to attract new participants if at least 70% are losing money? The answer is aggressive affiliate marketing creating the illusion of easy wins. These sports betting and gambling groups are the most prolific affiliate commission payers, often giving out 30% commission rates.

While I’m not opposed to coaching or groups in general, as long as there’s real value being provided, this often feels like a house of cards.

The AGI deadline creates a weird psychological state. It’s like knowing the party ends at midnight. Everyone optimizes for short-term extraction rather than long-term relationship building. And you can feel this in how people approach work, relationships, and time itself.

Having navigated the memecoin wave and the broader internet money movements, I’ve realized it was never about the “tech” or betting on culture that made memecoins popular (as many VCs and crypto experts thought and may still think). It was the rush of the underlying “make money online” cohort.

The same group migrated through:

eBay reselling (2005–2010)

Affiliate marketing (2010–2014)

Dropshipping (2015–2018)

Social Media Marketing Agencies (2017–2020)

TikTok Shop (2023–2025)

And now some SMMA operators are (unfortunately) trying to co-opt AI automation (2025→)

This financial independence through internet money has been present for a while. But AGI and AI discussions, paired with our next topic of discussion, have created an atmosphere where internet capital markets feel like the only viable path to wealth.

2) A Regular Job is Now a Path to the New Lower Class

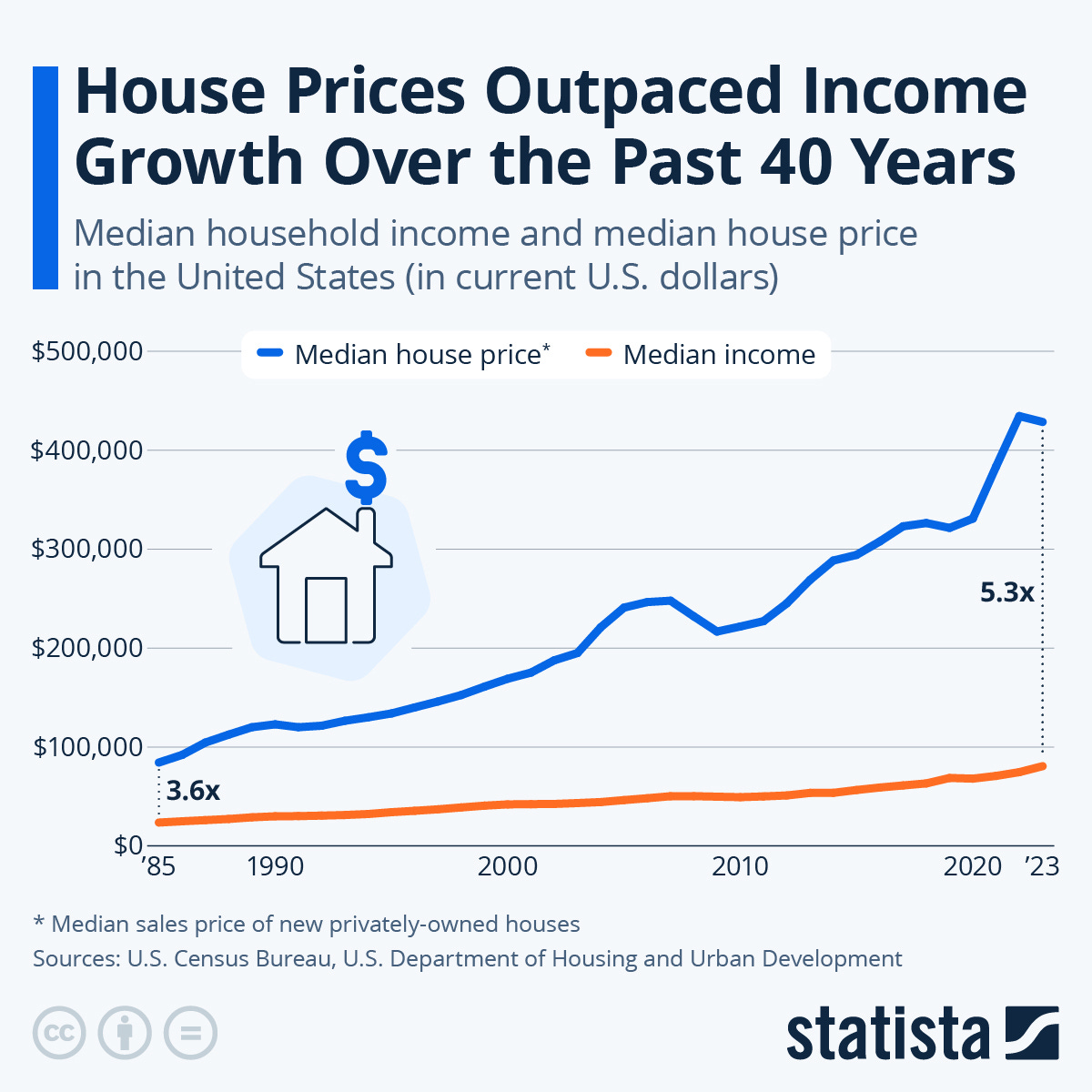

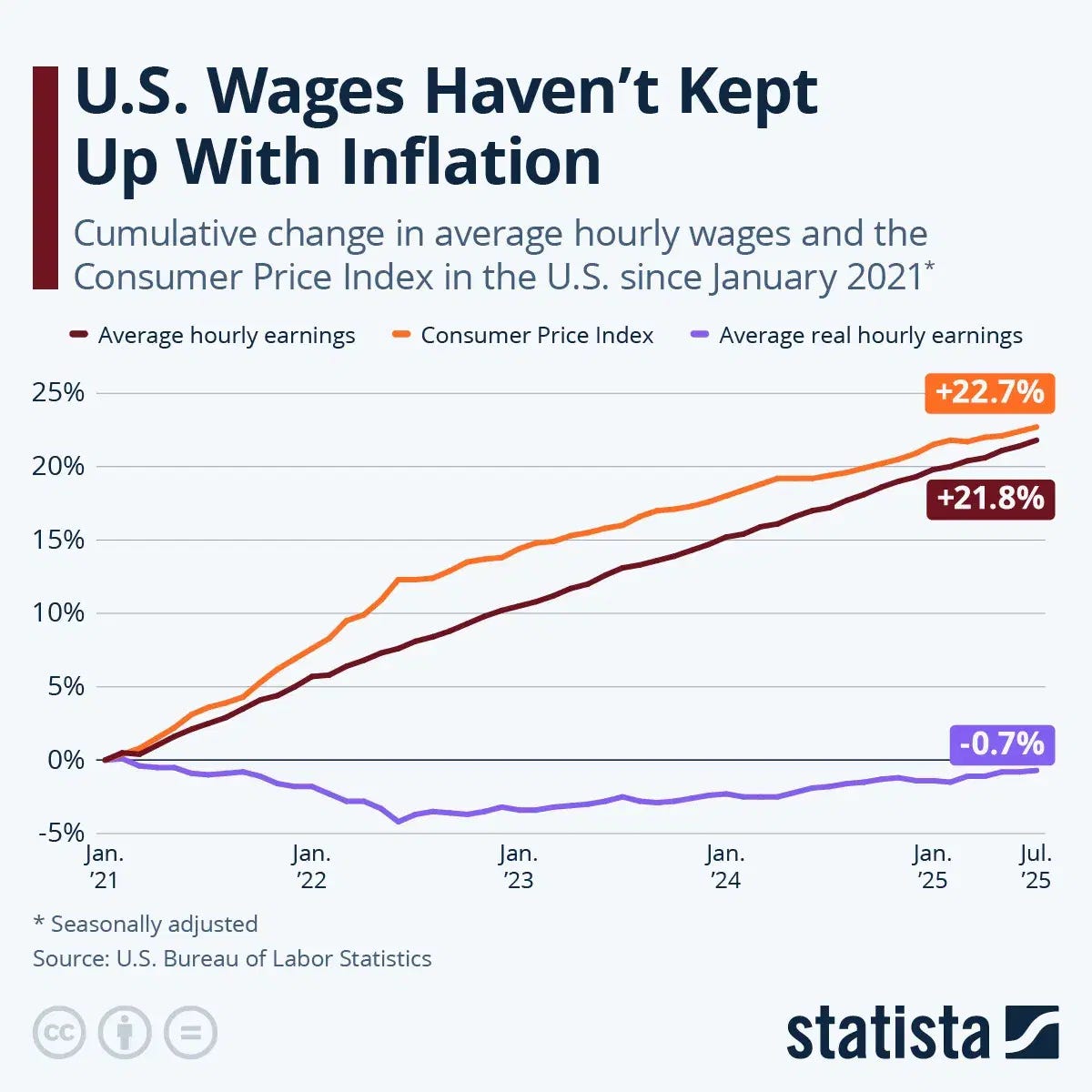

Here’s a number that should terrify you: over the past five years, home price growth has nearly doubled wage growth.

If you’re a teacher, nurse, or skilled tradesperson earning $75,000 (solidly middle class by traditional definitions) the wage-to-home-price ratio has fundamentally restructured what “success” means.

The price-to-income ratio now stands at 5x, compared to the historical norm of 3-3.5x. This is not a temporary blip. This is a fundamental restructuring of what “middle class” means in America.

The middle class is the new lower class when measured by asset accessibility.

Real wages are falling while inflation persists.

This creates a fascinating cultural dynamic. The traditional markers of success, steady job, savings account, good credit no longer translate to the traditional outcomes of success. No house. No generational wealth building. No security.

The youth understands this, leading to what may seem imprudent but is actually a very rational decision: playing a different game. The game of internet money.

People start looking for asymmetric bets. Lottery tickets. Memecoins. Coaching programs promising 6-figure months. It’s a rational response to a rigged game.

3) The Social Capital Vacuum

This one’s harder to quantify but impossible to ignore once you see it.

When I look at people in their 20s and 30s, there’s a consistent pattern, weaker family ties, fewer close friendships, less community involvement. The traditional sources of validation and meaning are eroding faster than we’re building new ones.

When social capital evaporates, financial capital becomes the primary, sometimes the only, signaling mechanism.

There’s also a pure business calculation at play. Luxury cars and Miami penthouses are typically bad investments unless they bring in more money than you would have made without them as marketing assets (which they often do).

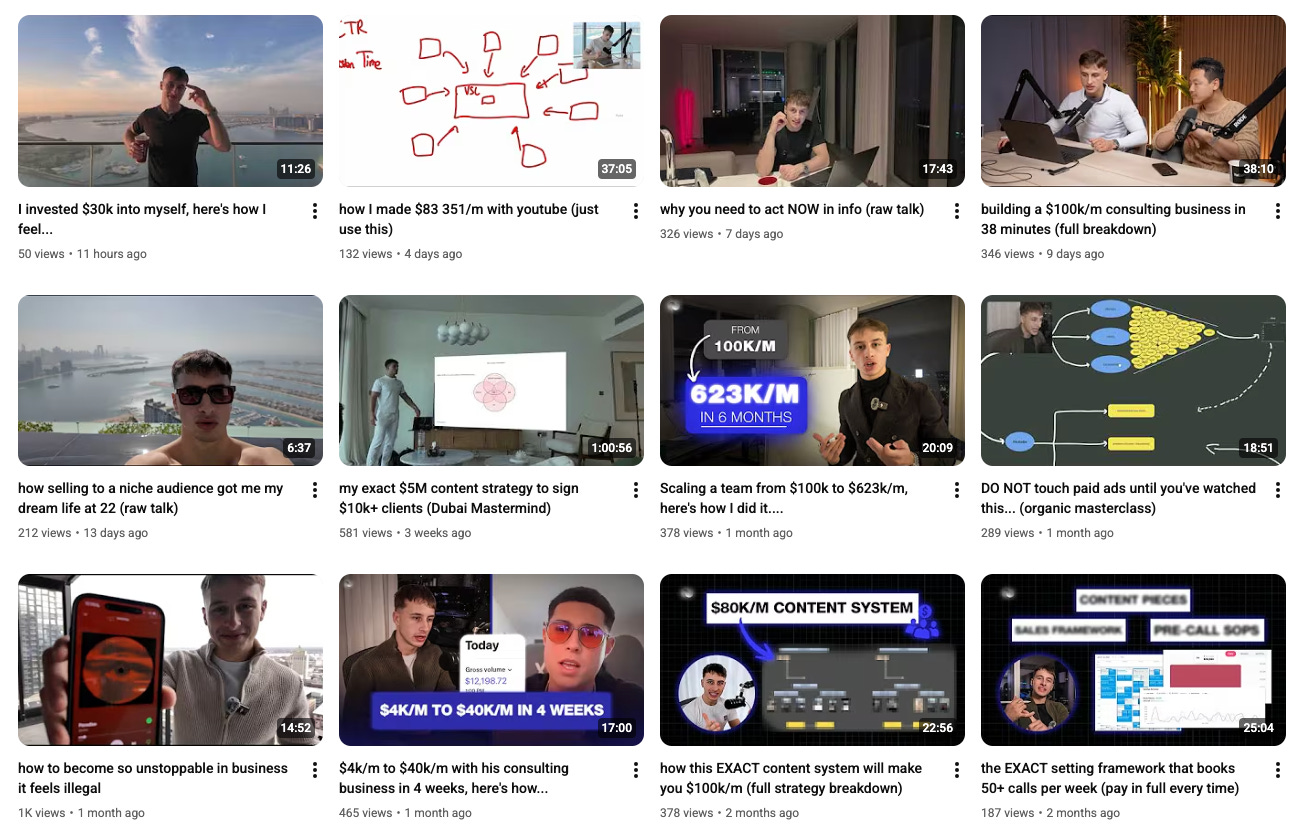

People take mental shortcuts. Seeing someone with a luxury car or penthouse (rented or not) signals competence to potential clients. I’ve studied these coaches to the point where I know their entire funnel:

Top of funnel content shows an attractive lifestyle that maximizes views and paints the main character as successful (this could be you)

Separate “business” account for educating people on your unique mechanism to success (this is how I did it)

Social media didn’t create this vacuum, but it made it visible in high definition. Everyone can see everyone else’s financial signals, all the time, while genuine connection becomes harder to maintain and impossible to photograph.

So What Do You Actually Do About This?

I’ve spent the last year thinking about this problem from a builder’s perspective. If you’re creating products, services, or businesses in 2026, you have three strategic options. They’re not mutually exclusive, but they require different timeframes and risk profiles.

Opportunity #1: Ride the Wave (The Casino Strategy)

The most obvious play is to acknowledge the behavior and design for it rather than against it.

Build lottery mechanics into everything.

People are genuinely drawn to asymmetric upside possibilities right now. Prediction markets hit $13-15 billion in annual volume by late 2025 precisely because they offer this psychology in a tradable format.

This applies beyond prediction markets and crypto:

Variable reward systems in SaaS: Unpredictable bonuses that keep users engaged

Surprise-and-delight moments: Loot boxes, mystery reveals, random upgrades. We’ve gone as far as selling lost parcels as loot boxes. NFT projects and sneaker brands ran this playbook successfully.

Community-driven outcomes and affiliate markets: Viral sharing loops that create exponential growth

Gamification that creates status: Leaderboards, badges, recognition systems

Having seen all these strategies play out over seven years in crypto markets, I’ll say this: it’s certainly not the most ethical path and often short-lived. The nature of gambling is that only a small segment wins, and your business runs only as long as the losers (the 99%) want to play.

The winners will be those who utilize these mechanics but distribute rewards in a way that doesn’t feel rigged.

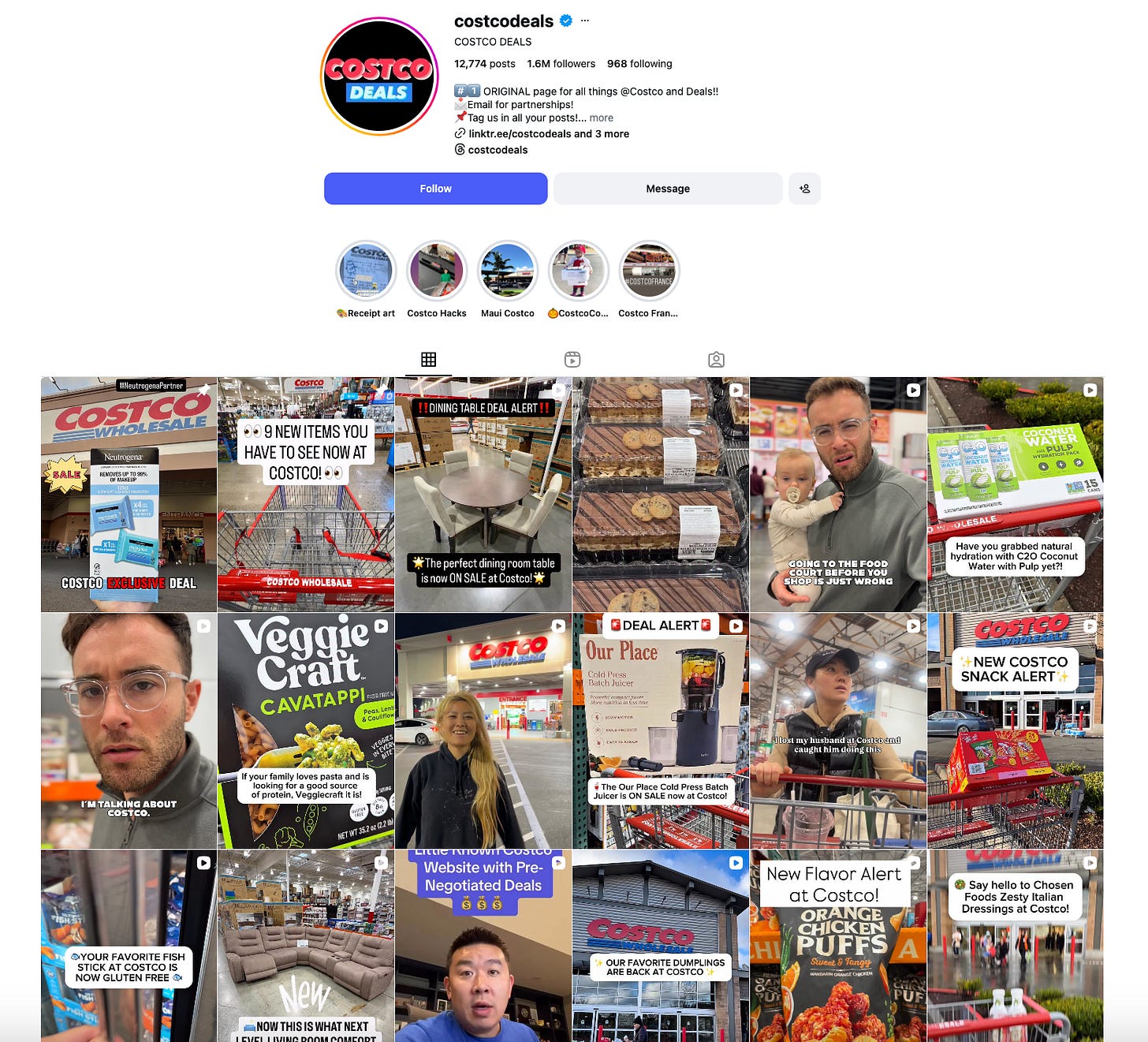

Maybe Costco has gotten it right all along … the treasure hunt experience without the existential dread of losing your life savings.

Time horizon: 1-3 years

Risk level: Low (moving with the current)

Upside: Immediate traction, matches user psychology

Opportunity #2: Create Modern Financial Engineering

Mortgages are just levered bets on the housing market that the youth is increasingly less willing or able to take. This creates an opening for entirely new funding models.

The Rent-to-Own Gap

The obvious opportunity nobody’s filling is a rental company that credits rent payments toward ownership with zero money down.

Everyone acknowledges the rent-vs-buy trap, but I have yet to see a major development company implement this model cleanly.

Why not? The incentive structures are misaligned. Developers want lump-sum payments. Landlords want perpetual renters. Nobody’s optimizing for the renter’s actual best outcome.

The Demographic Timing Play

A less obvious strategy is positioning for the demographic age distribution shift.

As boomers age out over the next decade, housing inventory will flood the market. The question is whether you’re positioned to capitalize when it happens.

This could mean:

Building capital reserves now to deploy when prices correct

Creating acquisition vehicles that can move quickly at scale

Developing property management infrastructure that can absorb inventory

Establishing brand and trust before the opportunity window opens

DeFi Unlocks Alternative Collateral

Traditional finance requires traditional collateral: houses, 401(k)s, established credit. Younger demographics often don’t have these. But they have other verifiable assets: income streams, reputation scores, provable skills, even NFT holdings.

Structured products that accept alternative collateral could unlock massive capital formation. Platforms like Parcl are already enabling housing index participation without capital lock-up, but we’re still in the first inning.

Time horizon: 3-7 years

Risk level: Medium (infrastructure plays take time)

Upside: Massive if you get timing right, creates defensible moat

Opportunity #3: Alternative Sources of Validation

This is the bet I find most intellectually interesting.

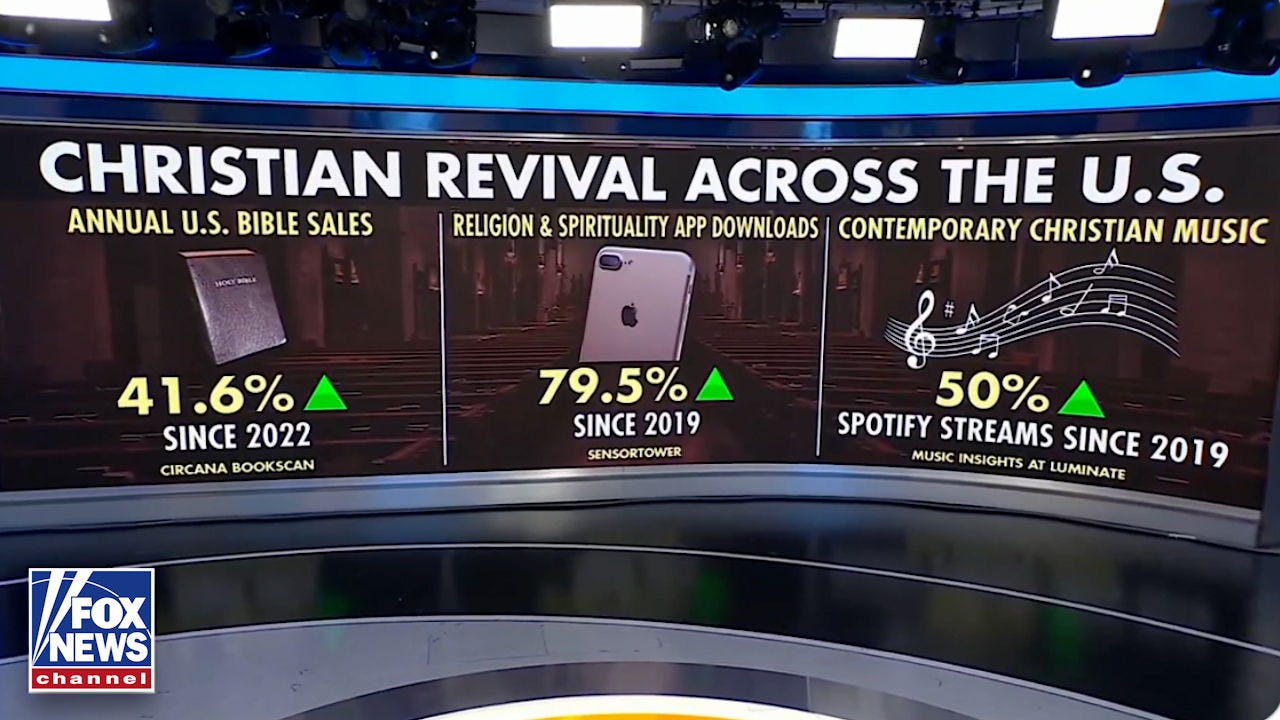

Every cultural movement has a counter-movement. Disco led to punk. Excess led to minimalism. Romanticism gave way to Realism. The pendulum always swings back.

Right now, we’re at peak financialization and materialism. Which means the reversal is coming. People aren’t chasing money because they love money. They’re chasing it because the traditional validation mechanisms have eroded. When someone is constantly seeking the next hit of dopamine, the next trade, the next viral moment, it signals an underlying lack of validation from non-monetary sources.

Early indications of the pendulum swing:

Faith-based apps seeing surging adoption despite being orthogonal to wealth signaling

“Dumb phone” movements gaining traction specifically among high earners

Premium on “real” experiences over digital simulacra

Analog advertising recapturing mindshare as digital becomes saturated

Sports and fitness (see Hyrox) creating mini-religions and community

The opportunity: Build products that validate users through non-monetary means before this becomes the obvious move.

Think about what this looks like in practice:

Physical experience services that create genuine connection

Community platforms that recognize contribution beyond capital

Achievement systems that measure growth in dimensions other than wealth

Spiritual or philosophical frameworks that provide meaning beyond consumption

Cultural spaces that allow people to interact in new environments

This is the riskiest play because timing is everything. Too early and you’re dismissed as naive. Too late and you’re derivative. But if you get it right, you’re positioned as the antidote to the exact problem everyone’s experiencing.

While you may disagree with Adam Neumann’s methods, I believe projects like Flow are, on an idea level, very well-positioned to take advantage of these trends. However, timing and execution before demand fully materializes is everything.

After enough people get burned by hyper-gambling, I think we'll see the pendulum swing back to grounding oneself via real experiences. The companies that position early in that gap will do well.

Time horizon: 5-10 years

Risk level: High (cultural timing is hard)

Upside: Category creation, strong brand moat, missionary customers

Opportunity #3.1: Communities 2.0

While I deliberately avoided crypto talk before (since these solutions are crypto-independent), I still think incorporating blockchain tech thoughtfully can unlock significant value.

a) Proof of Authenticity in an AI World

There’s a massive trust issue, even among younger demographics, when it comes to coaching receipts and claimed results.

More verifiable than any vlog, Video Sales Letter, or fund screenshots (which can all be easily manipulated), you could designate a single wallet for business earnings that cryptographically proves you’ve hit the numbers you claim. This creates accountability that didn’t exist before.

In a world where AI can generate fake everything, on-chain proof becomes the last bastion of verifiable truth.

b) Global Real-Time Club Registry

NFTs make social capital tangible and visible. They give people something to strive for and provide entry into social circles they didn’t know existed (for better and worse).

But just like with stablecoins, for NFTs to become truly useful, infrastructure has to be built around them: the on/off ramps, acceptance solutions, DeFi composability.

I see this as a massive worldwide loyalty program: you hold the NFT, you get perks XYZ.

This also removes constraints and opens avenues for entirely new business models. (Although admittedly, obtaining an NFT can still be more tedious than traditional methods, but once you have it, the potential for convenience is transformative.)

Case Study: The Traveler Club That Can’t Exist Without NFTs

One concept that immediately comes to mind is a “traveler club” offering trips to random (or even undisclosed) destinations each month.

A simple popup asks if you’re going. You confirm. The backend reserves your ticket and links it to your NFT. Currently, accomplishing this requires navigating a maze of friction: email confirmations feel scammy, booking agencies demand too many steps and often feel untrustworthy. With this model, you scan your NFT and board the plane.

On the backend, there’s a social platform where each public key represents a user who can voluntarily sign up. You start connecting with other frequent travelers and forming real-life relationships. The beauty is that this happens without doomscrolling Instagram or TikTok or wading through endless noise to find value. It finally lets you go offline while receiving only the most curated insights via push notifications. Each NFT functions like a mini app/community actually tailored to your preferences, one you’ve actively chosen to join.

Why Whop and Skool Could Fail

Platforms like Whop and Skool are attempting to monetize community building by taking a page from the NFT 2021 playbook.

But just like the stablecoin analogy, the fact that memberships are built on closed, siloed infrastructure means they’ll always face the last-mile delivery problem. They’ll always be single-purpose access tokens for a single website. Nothing more, nothing less.

I believe the force pushing toward disaggregation will ultimately prove stronger than the force toward aggregation. We’re already seeing this play out via:

Creator exodus seeking platform independence

Platform risk becoming unacceptable

Monetization conflicts between creators and platforms

Open registries solve this. They enable new composable social networks that current siloed providers simply cannot build. NFTs will do to identity and membership what stablecoins are doing to money movement rails (which are much more established).

The Front End Doesn’t Matter. The Registry Does.

If AI proliferates, NFTs curate. The price of an NFT could (though not necessarily) signal value beyond likes and engagement metrics.

The front end may change (iPhone, Meta’s AR glasses, voice interfaces) but the beauty of blockchain is that it’s essentially an open registry linking people to multiple public addresses.

As long as you can prove you own your public key (whether async or in real time), the end interface doesn’t matter. Phone, glasses, even voice.

Maybe the Worldcoin guys were onto something there.

To avoid the dead internet theory, we need to create pockets that mean something. NFTs could be the vehicle to provide it.

The Path Forward

The smartest builders pursue all three opportunities simultaneously, creating optionality across different timeline scenarios.

What I’m Watching

I’m tracking leading indicators of cultural shift:

Adoption rates of faith-based and meaning-focused apps

Premium positioning of analog experiences over digital

Emergence of alternative collateral models in DeFi

NFT infrastructure development beyond speculation

Physical community formation rates among digital natives

Cult-like followings forming around new sports movements

This shift is happening whether you’re ready or not. The only question is whether you’ll build something that matters or watch from the sidelines.

I’m building in this space. If you’re thinking about these problems, let’s talk:

LinkedIn: https://www.linkedin.com/in/jurgis-pocius/

Email: jurgis@evoaai.com

Join for emerging tech insights from strategy to implementation. Trusted by Dior, JPMorgan, and Nike. Because after all, Jeff Bezos found the idea for Amazon via a newsletter just like this.

This hit for me, and there’s a builder-level test hiding inside it:

Most “casino products” win because they sell variance, not value.

They hide expected outcome behind a story (“you could be the one”), then monetize the losers staying hopeful.

So here’s the non-obvious diagnostic:

- Run the House-Edge Test:

Take your landing/onboarding and remove every “lottery signal” for 48h (big upside claims, lifestyle proof, vague speed promises). Replace with a clear outcome curve: what a user gets in 7 / 30 / 90 days, and what effort it costs.

If demand collapses, you weren’t selling progress, you were selling possibility.

What are you building that still works when the “hope” layer is stripped away?