Where DeFi Yield Actually Comes From

The real economics behind stablecoins, looping, and institutional DeFi

DeFi has officially hit its inflection point. While DeFi’s Total Value Locked (TVL) has corrected to roughly $100 billion across all chains, early 2026 is shaping up as the breakout year for the convergence of traditional finance (TradFi) and decentralized infrastructure.

Major banks are no longer confined to innovation labs. They are deploying live pilots with real balance sheets and billions on the line. January 2026 headlines from the World Economic Forum spotlight JPMorgan’s JPM Coin expanding onto public blockchains for seamless 24/7 payments, alongside Citigroup’s Token Services enabling near-real-time cross-border clearing. This shift extends beyond banks. Infrastructure and payments companies like Stripe and Fireblocks are rolling out crypto-native settlement and network layers built for institutional scale.

These are no longer experiments. They reflect a growing reliance on DeFi rails where they outperform legacy systems.

But as capital floods in, one question matters more than any other for builders and investors alike:

Where is this yield actually coming from?

1. Yield Comes From Lower Operating Costs

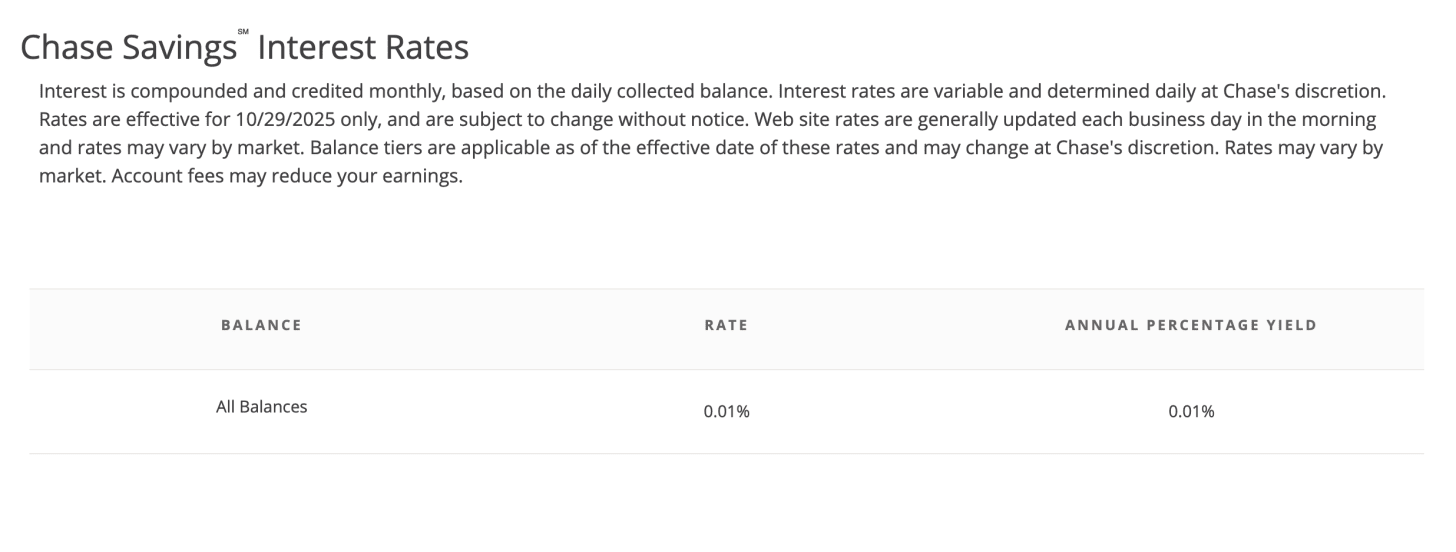

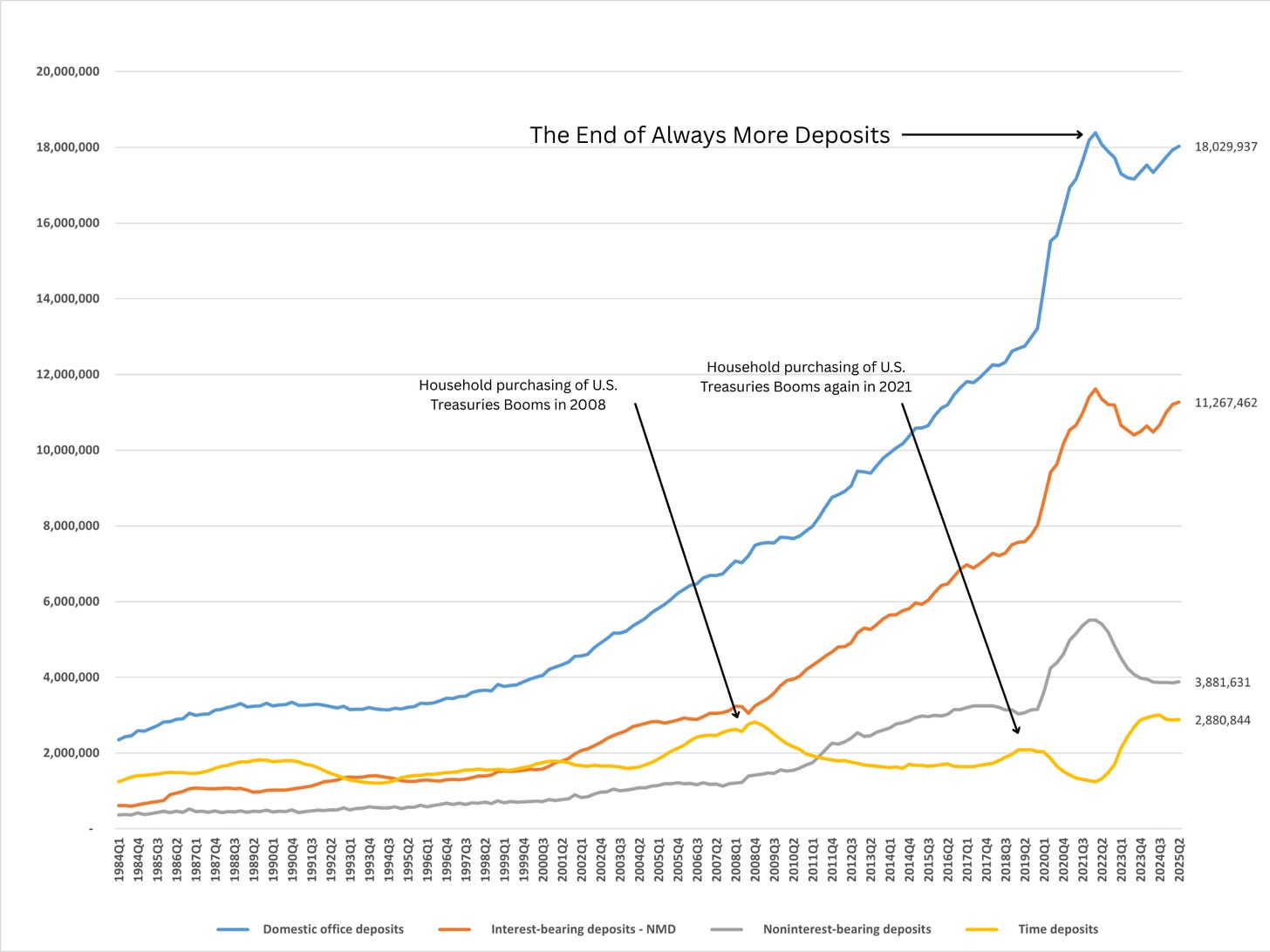

It’s no revelation that traditional retail banks offer negligible APYs on consumer deposits.

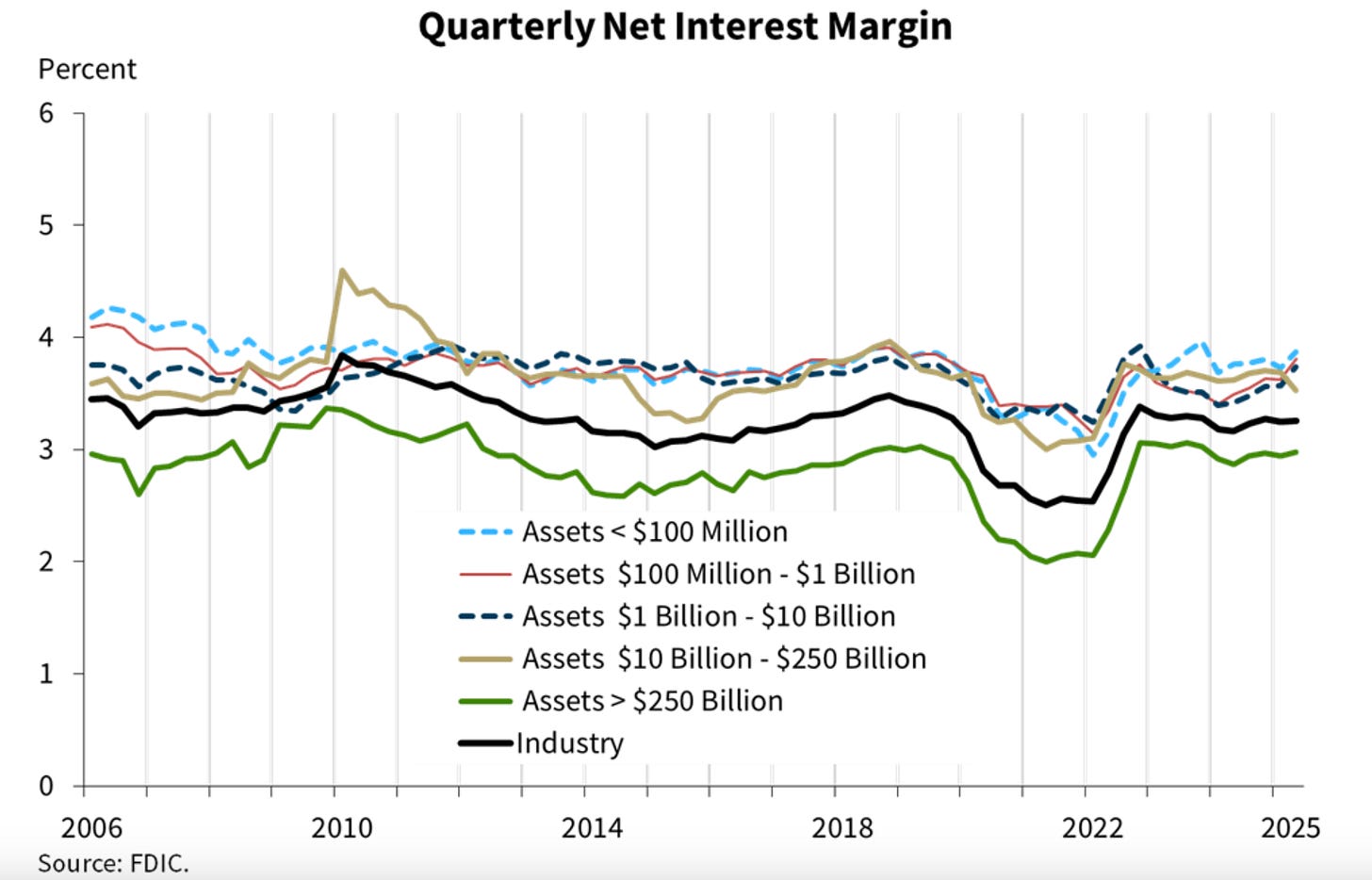

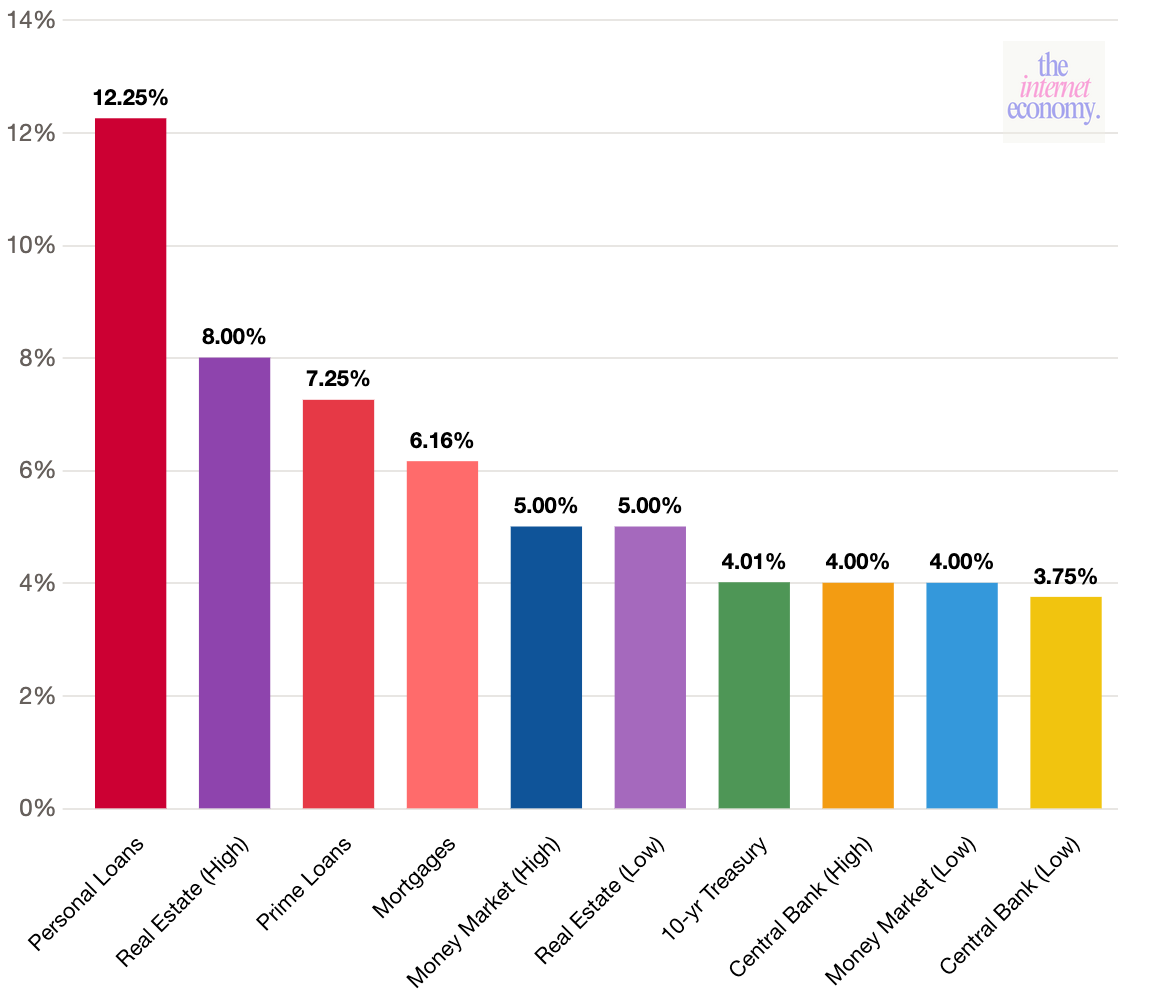

The core big-bank business model is built around net interest income: borrowing money at effectively zero through deposits and lending it out at meaningfully higher rates. Interest income typically accounts for roughly 70% of bank revenue, with the remaining 30% coming from non-interest income.

That non-interest income shows up everywhere: monthly account fees, overdraft fees, ATM and wire fees, debit and credit card interchange, credit card interest, and commissions on insurance and investment products.

Borrowing at 0% and lending at 8%+ is a very good business.

Why are fintechs able to offer higher rates?

The primary reason is lower operating costs. Fintechs like Revolut, now a ~$75B company, operate with no physical branches and far leaner cost structures. That efficiency allows them to pass through a larger share of interest income, often earned on Treasuries, directly to customers. It’s their core customer acquisition strategy, as yield becomes a marketing expense designed to pull deposits away from banks.

Fintechs also reprice faster. When the Federal Reserve hikes benchmark rates, fintechs tend to adjust savings rates quickly. Large banks, constrained by internal bureaucracy and legacy systems, move slowly. Over time, that lag compounds.

Many fintechs are also willing to lend deposits into higher-yielding, riskier asset classes than traditional banks, further expanding the rate spread they can offer to users.

As a result, interest-bearing deposits have become table stakes across fintech and neobank platforms, and depositors are increasingly demanding utility from idle balances rather than accepting zero yield.

It’s worth noting that most fintechs still don’t hold deposits themselves. Without a banking license, they’re required to place customer funds with licensed partner banks. Yet even within that constraint, fintechs are often able to negotiate higher APYs for their users through a combination of scale and economics:

Bulk deposit negotiation

Revenue-sharing agreements

Lower servicing costs

Higher interchange capture on debit and credit cards

Cross-sell incentives

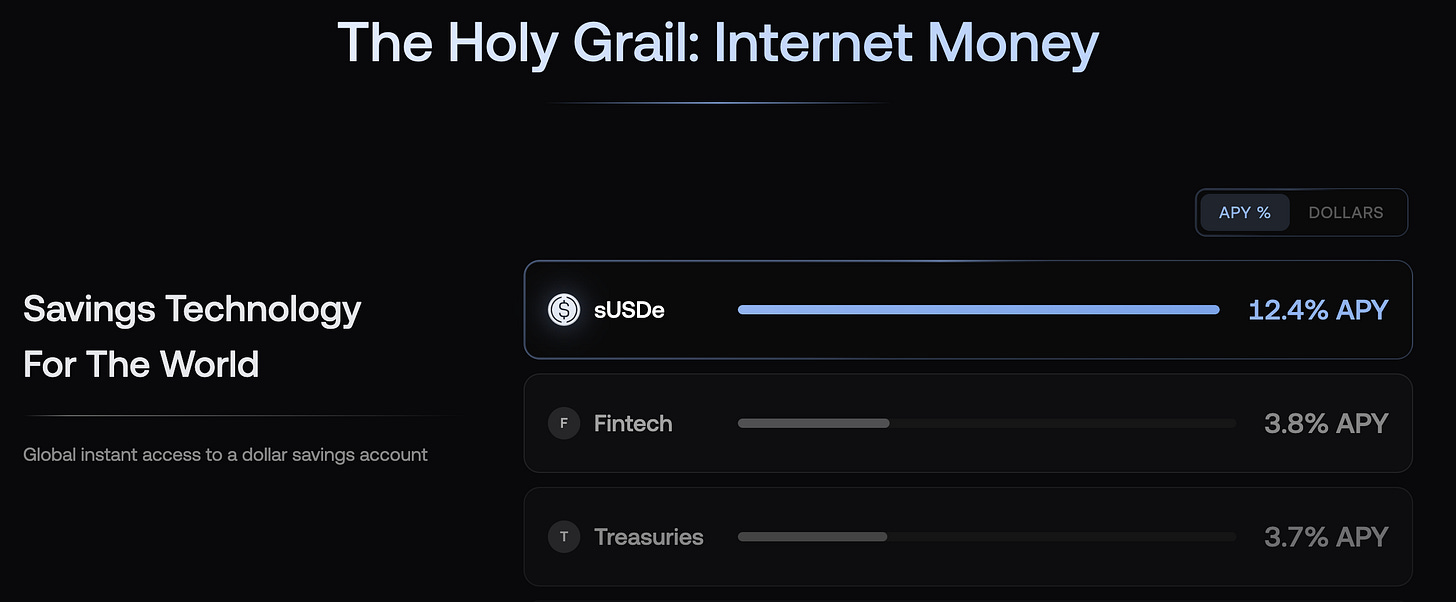

This is where stablecoins push this model to its logical extreme.

Stablecoins resemble fintechs on steroids: lean teams, minimal operating expenses, and a far greater ability to pass through Treasury yields directly to users.

As yield distribution (directly or via loopholes) gets normalized via stablecoin as a service providers like M0, Agora, Paxos and Bridge, capturing the customer mindshare will require

a) existing distribution, or

b) growing distribution via marketing (which increases operating expenses).

Just like the Ethereum blockchain is optimized for decentralization, big banks are optimized for capturing net interest margins and maturity transformation.

It’s ultimately a design choice.

2. Yield Comes From Lending to Traders

Yield from passing on Treasury rates is the most vanilla form of DeFi yield. It works, but it has a ceiling. Over time, those rates compress, and the advantage fades.

DeFi’s more interesting yield sources begin once capital is put to work inside markets rather than parked against government debt.

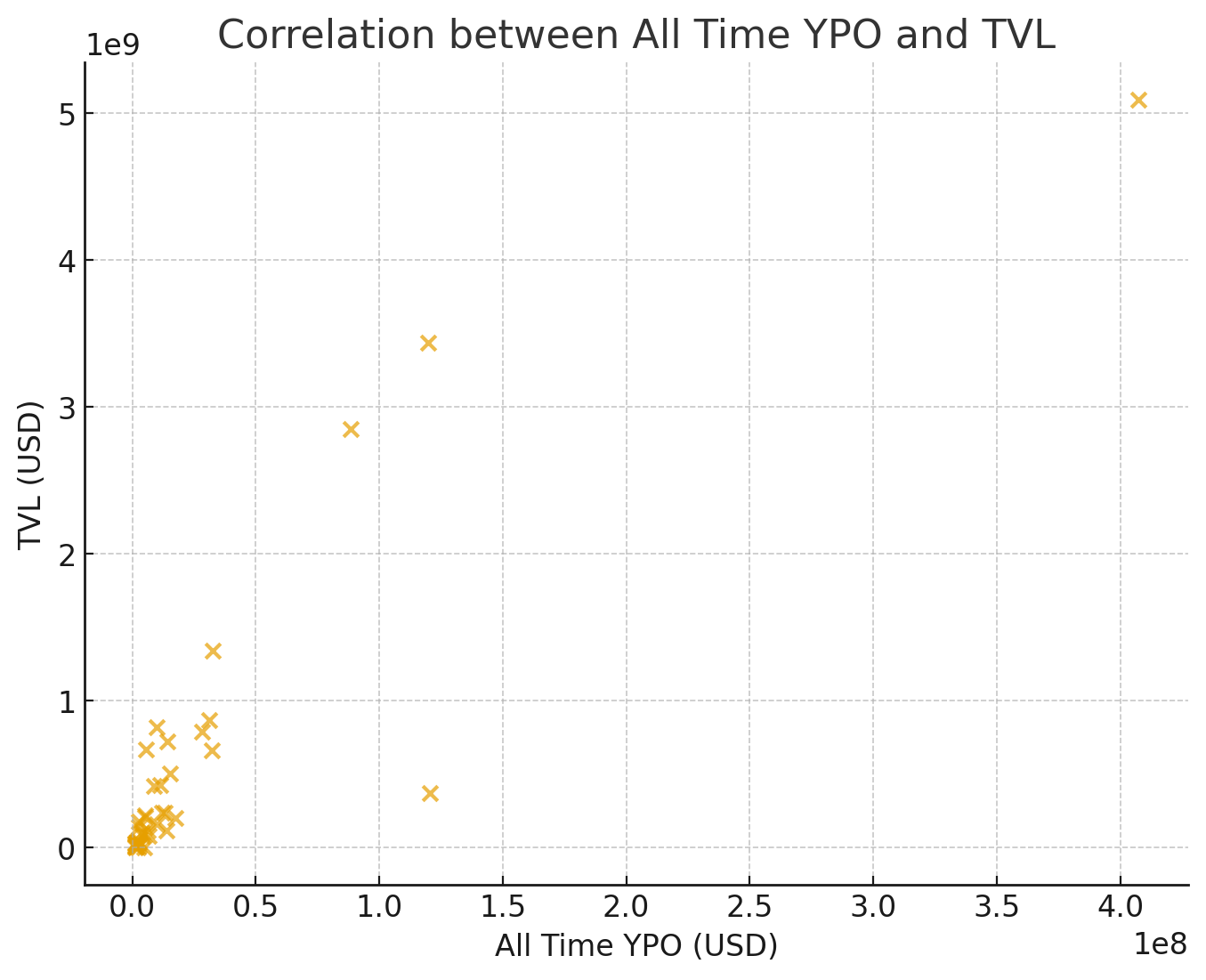

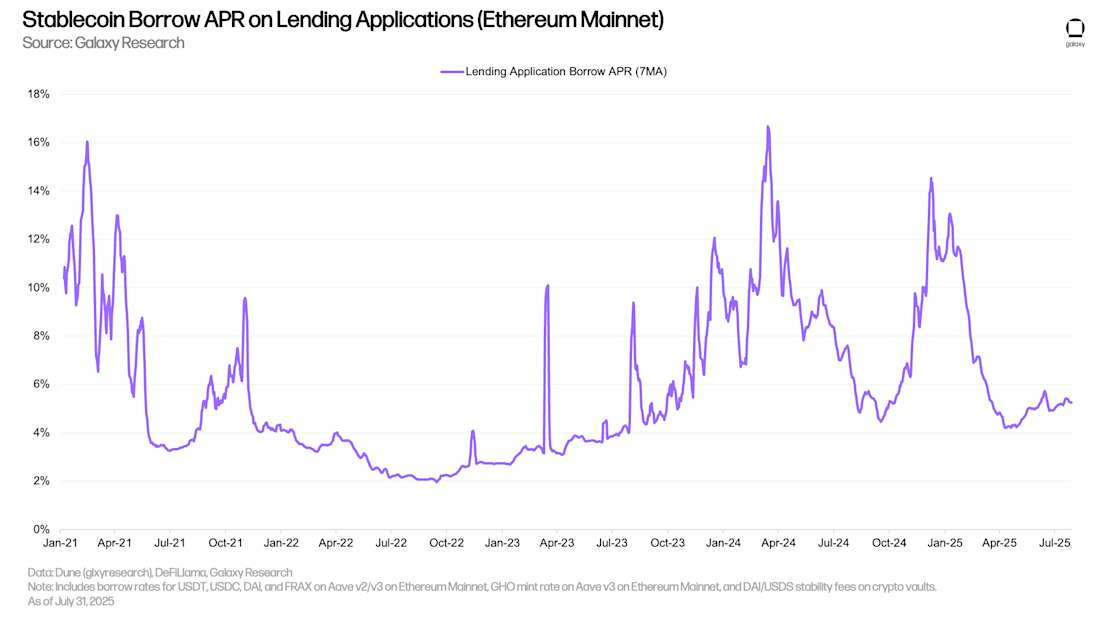

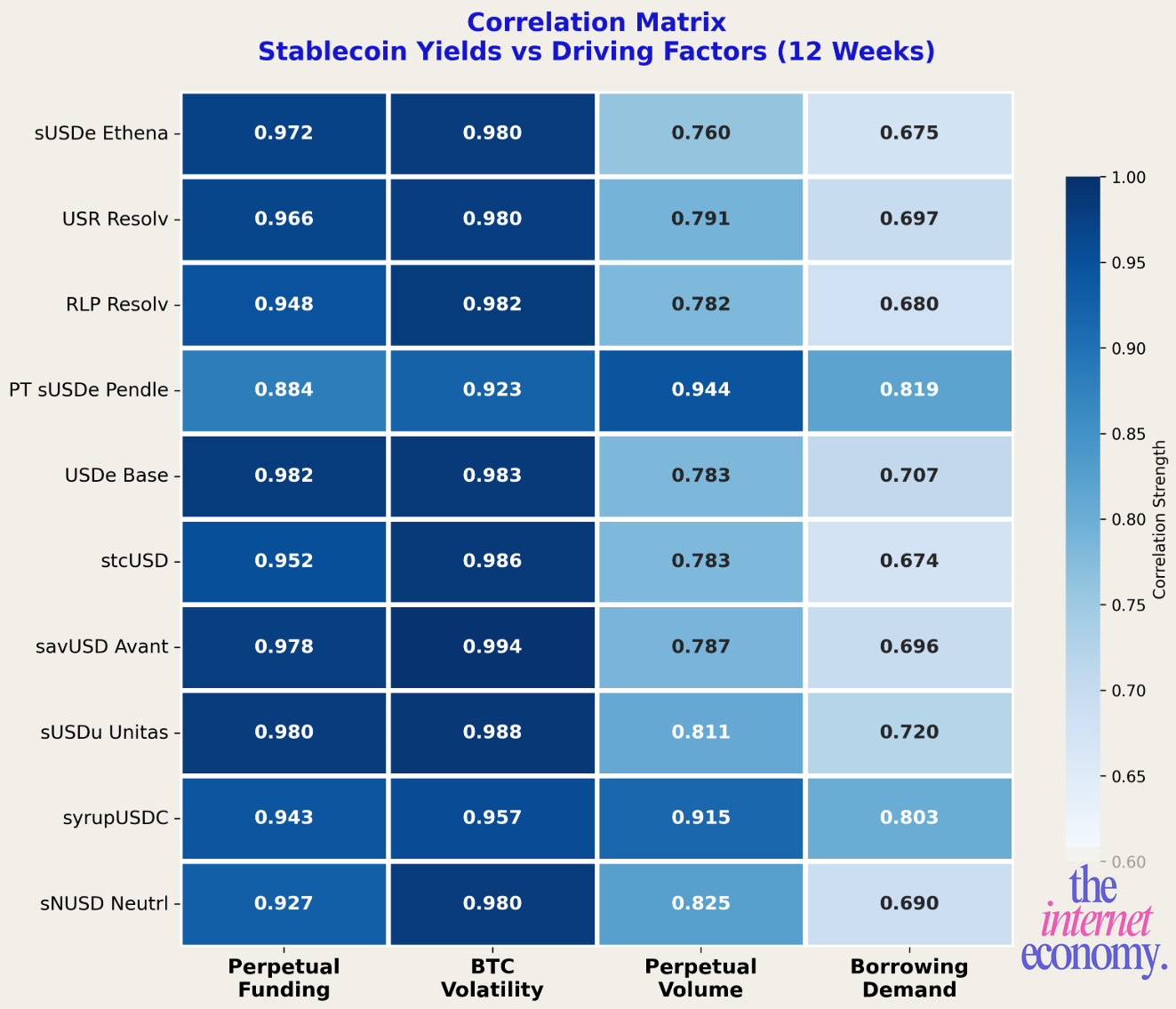

One of the most important drivers of DeFi yield is trading activity.

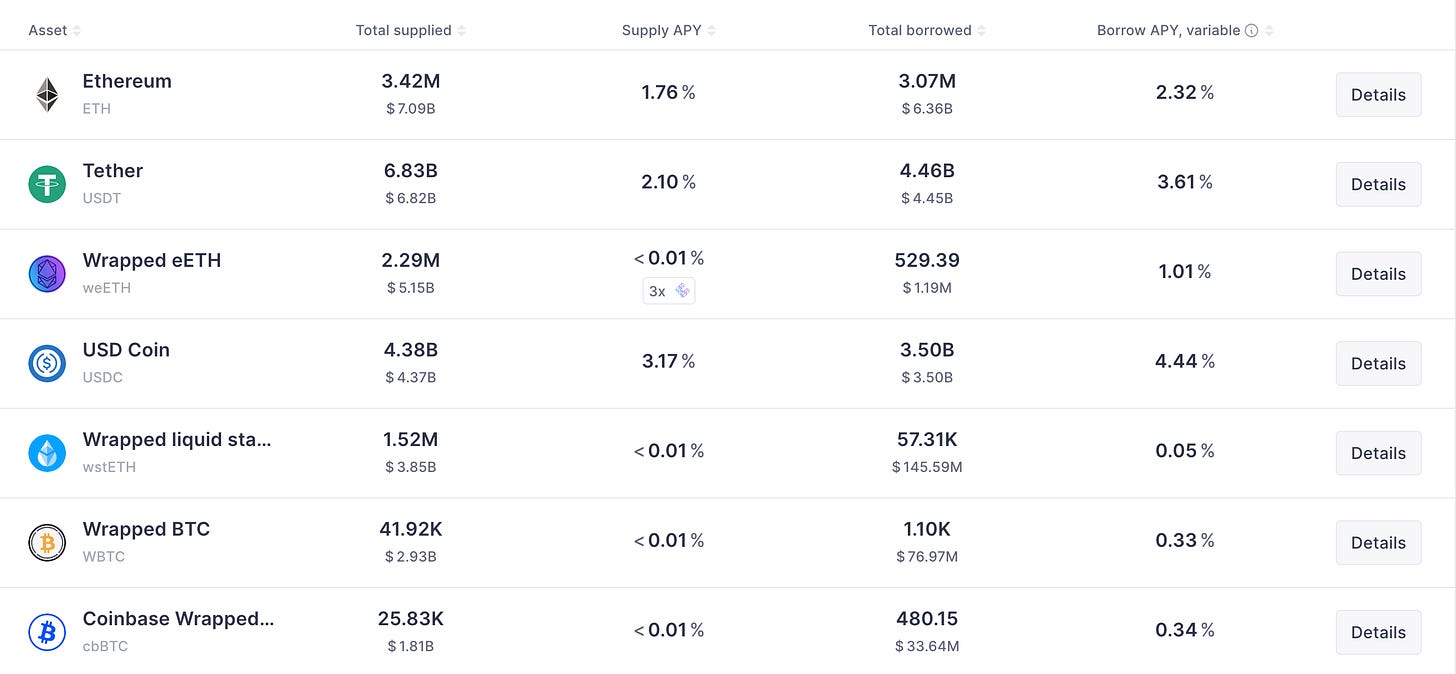

Across lending markets, stablecoin borrowing rates tend to rise alongside ETH prices. As prices move higher, demand for borrowing stablecoins increases, pushing lending APRs up in tandem. The relationship is not perfect, but the directionality is clear.

Several forces reinforce this dynamic:

Rising asset prices increase collateral value, which expands borrowing capacity and enables larger positions. Borrowed stablecoins are often redeployed into additional market exposure, reinforcing price momentum.

The opportunity cost of lending stablecoins increases during strong market moves. Holding ETH directly becomes more attractive, so lenders require higher compensation to remain in stablecoins.

Increased demand for leverage. Stablecoins serve as the primary margin asset across perpetual futures markets, supporting both long and short positioning. People longing start to think it’s the beginning of a super cycle, people shorting think it can’t go up that much more

A growing share of stablecoin yield is also tied to liquidity provision strategies that depend directly on trading volume (among other things). On Jupiter, 75% of liquidity provider fees come from opening and closing positions, price impact, borrowing costs, and trading fees. As leverage and activity increase, these fee streams expand. When volumes fall, yields compress

3. Yield Comes From Delta-Neutral Trading

Another major source of DeFi yield comes from delta-neutral trading strategies.

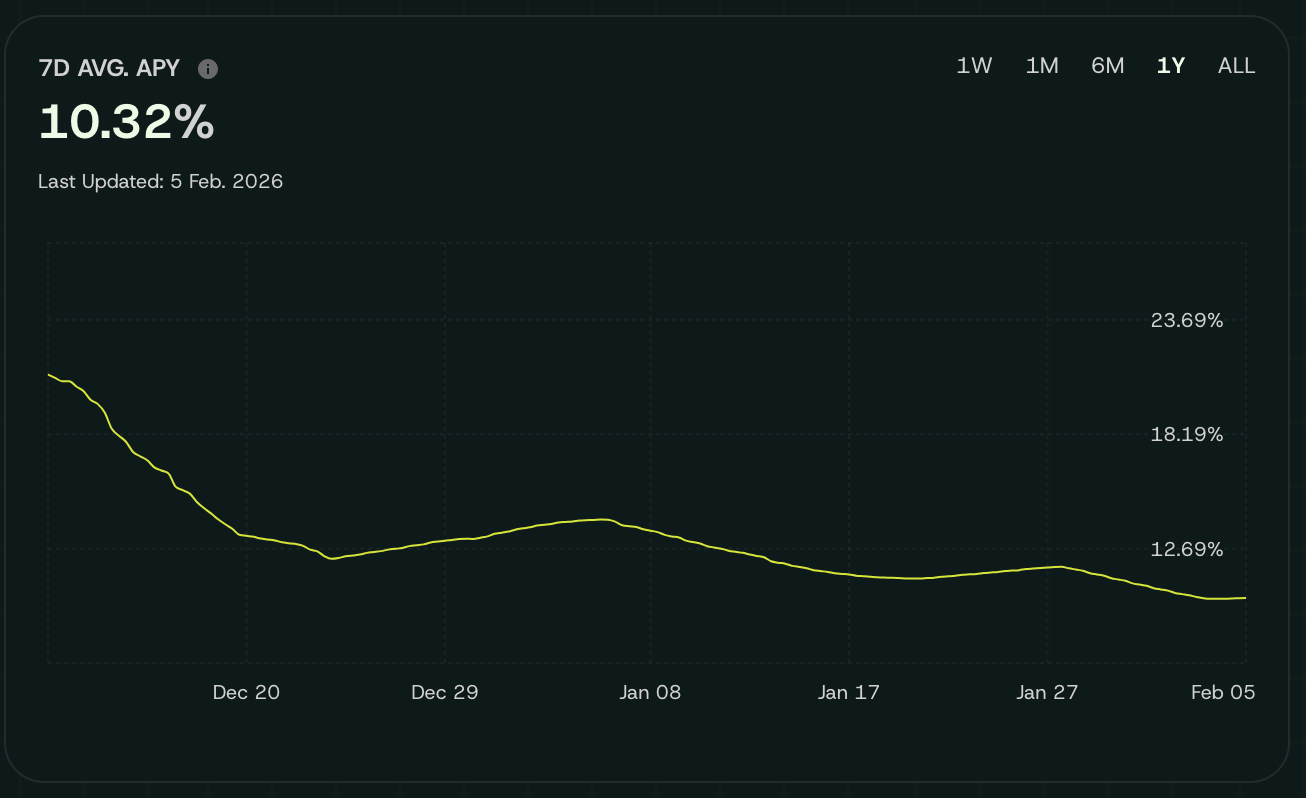

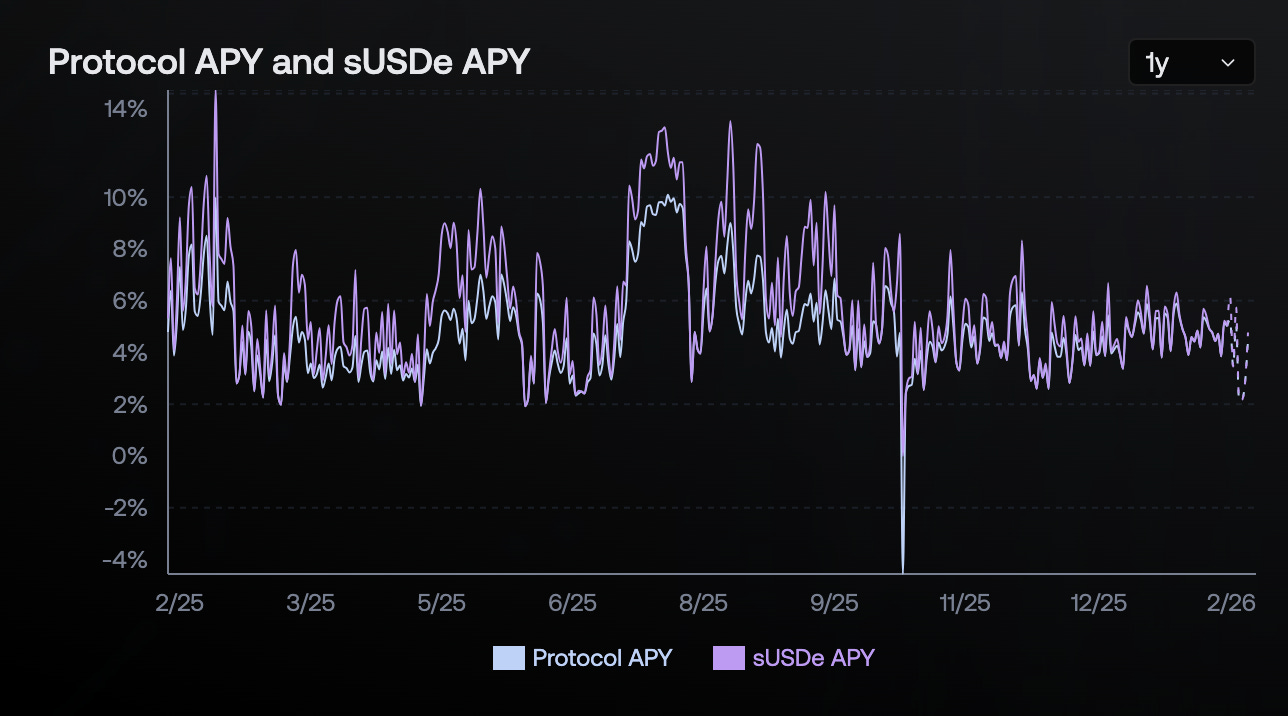

The popular example is Ethena’s sUSDe, a synthetic stablecoin backed by a delta-neutral structure rather than cash reserves. The system holds collateral such as ETH or stETH while simultaneously opening short positions in derivatives markets. The short offsets directional price exposure, while funding rates from perpetual futures generate income. The USD peg is maintained through continuous hedging rather than redemption against fiat.

A similar dynamic exists in RLP, the leveraged yield-bearing token developed by Resolv Labs. RLP functions as a risk buffer for the USR stablecoin, absorbing market and counterparty losses that arise from delta-neutral hedging. In exchange, RLP holders capture higher returns sourced from staking rewards and funding fees.

In both cases, yield is produced by managing basis risk and market structure rather than by lending against fixed collateral. The returns compensate holders for exposure to hedge execution risk, funding rate volatility, and counterparty dynamics across derivatives venues.

This form of yield sits structurally between lending and active trading, offering higher returns at the cost of greater operational and market sensitivity.

4. Yield Comes From the Wealth Effect and Tax Avoidance

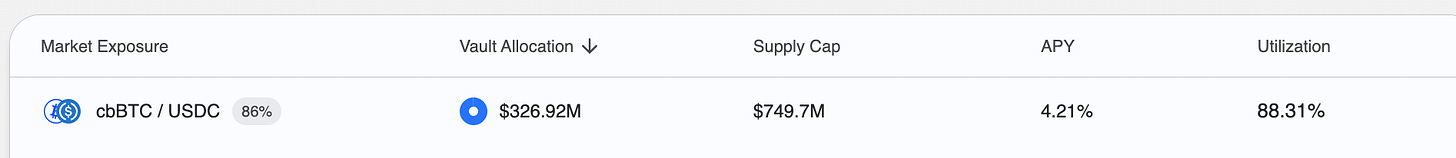

A useful example here is Gauntlet’s largest vault, USDC Prime on Base. The vault allocates nearly all of its assets to the cbBTC/USDC pool, lending out USDC against cbBTC collateral at roughly 4%.

The obvious question is who sits on the other side of that trade. Who is borrowing USDC against Bitcoin collateral? While some of this borrowing could be attributed to desire for leverage, because cbBTC is Coinbase’s wrapped Bitcoin product, it could be inferred that a significant portion of borrowers of USDC do so for tax purposes, while preserving investment in Bitcoin.

Selling Bitcoin triggers capital gains tax, while borrowing against it doesn’t. This is a familiar strategy in traditional wealth management, where high-net-worth individuals routinely borrow against equities, real estate, or other appreciating assets rather than selling them.

As Bitcoin prices rise, this dynamic strengthens. Higher prices increase collateral value, which expands borrowing capacity and pushes utilization higher.

In this case, yield is driven less by speculative trading and more by balance-sheet behavior tied to asset appreciation. The wealth effect increases borrowing power, and borrowing demand sustains yield even in relatively calm market conditions.

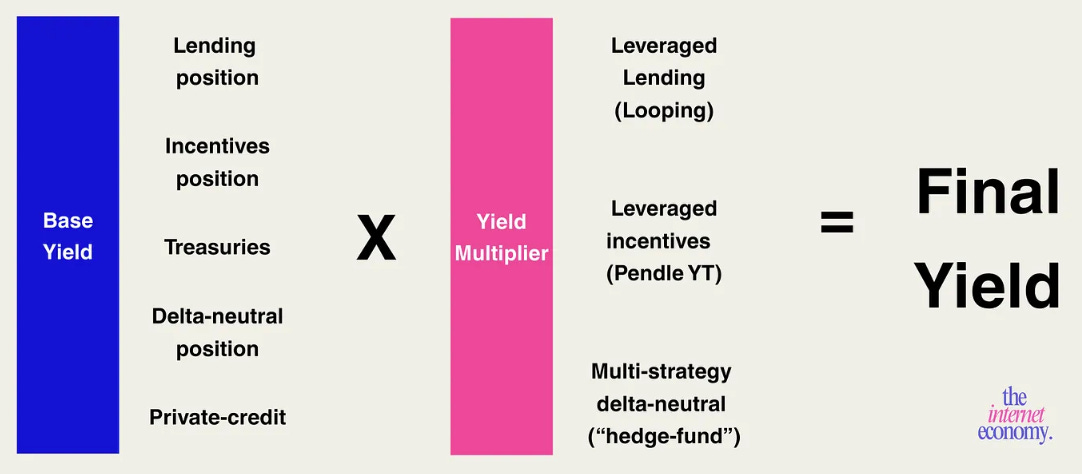

5. Yield Comes From Looping

Looping is one of the most direct ways DeFi turns leverage into yield. At a basic level, it involves repeatedly borrowing against collateral and redeploying the borrowed capital, constrained by loan-to-value (LTV) limits.

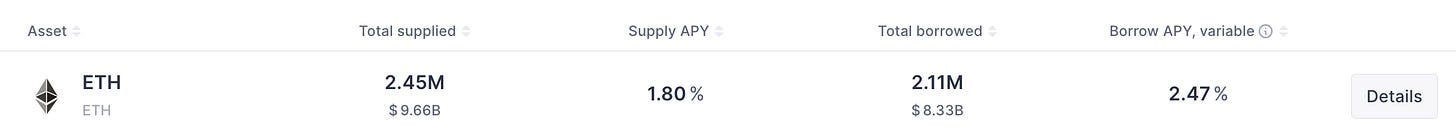

In its simplest form, looping uses volatile assets like ETH as collateral. With an 80% LTV and a borrowing rate around 2.47% APY, a maximally levered loop looks roughly like this:

Loop 1: Deposit $1,000 of ETH → borrow $800 in stablecoins → buy more ETH

Loop 2: Deposit $800 of ETH → borrow $640 in stablecoins → buy more ETH

Loop 3: Deposit $640 of ETH → repeat

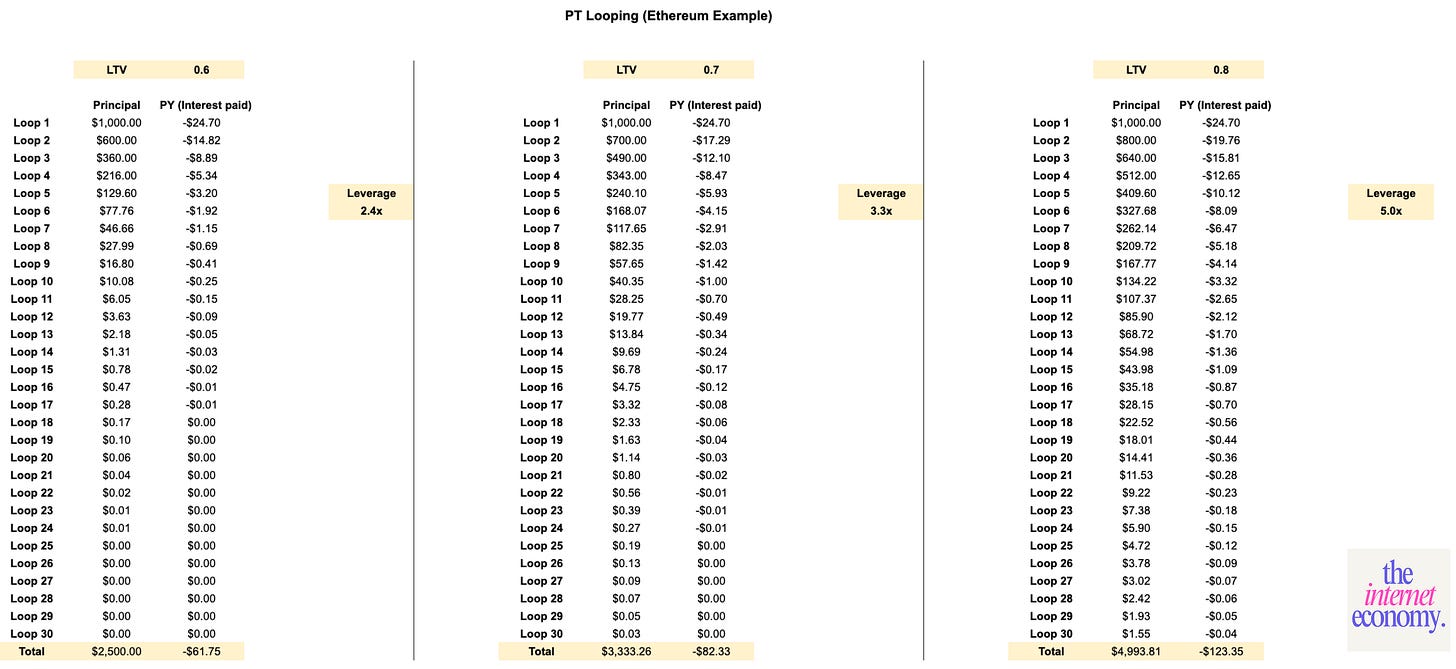

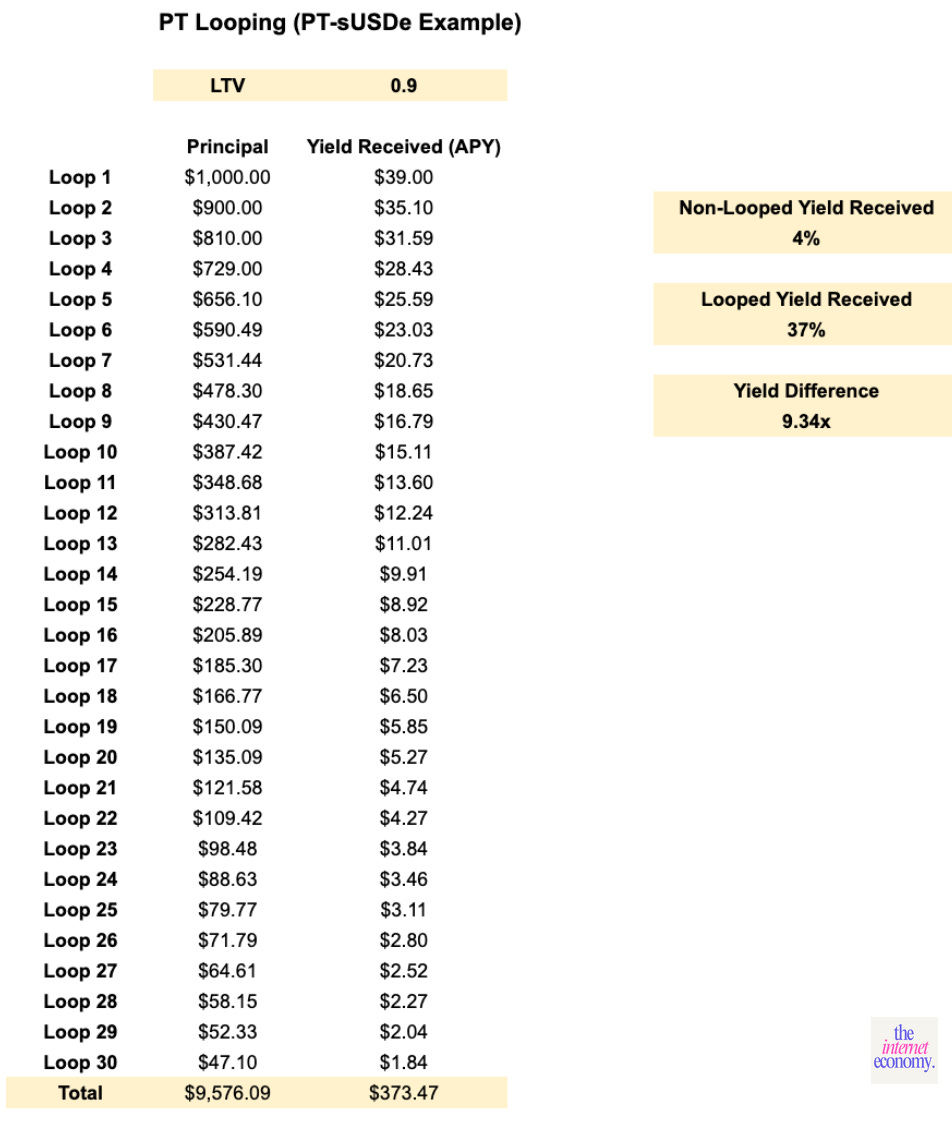

As you can see in the math below, each loop increases effective leverage, with the final leverage ratio determined by the LTV cap and the number of iterations.

This strategy assumes near-maximal leverage and minimal safety margins. In practice, few users run this to the limit. Even modest price drawdowns can trigger liquidations once collateral buffers thin out.

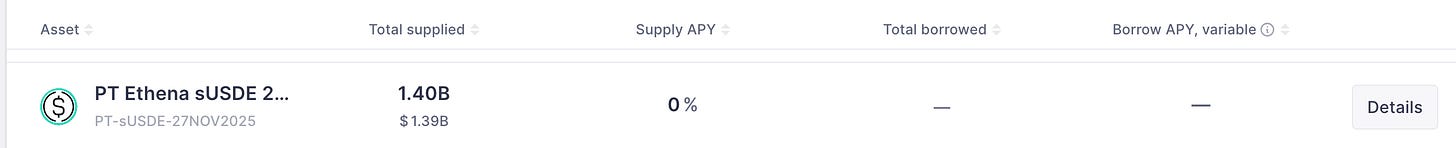

A more structurally interesting, and arguably safer, version of looping uses principal tokens (PTs) rather than volatile collateral.

This approach was enabled by Pendle, which introduced a way to separate yield-bearing assets into principal (PT) and yield (YT) components. PT holders receive fixed yield, while YT holders gain exposure to variable future yield. The market clears because one side prefers certainty and the other prefers convexity.

Instead of posting ETH or BTC as collateral, users can now post fixed-yield stablecoin instruments (such as PT-sUSDe) to borrow. Because these assets exhibit lower volatility, lending markets typically allow higher LTVs, often around 90%.

A maximally levered PT looping strategy looks like this:

Loop 1: Deposit $1,000 of PT-sUSDe → borrow $900 USDe → buy more PT-sUSDe

Loop 2: Deposit $900 of PT-sUSDe → borrow $810 USDe → buy more PT-sUSDe

Loop 3: Deposit $810 of PT-sUSDe → repeat

The effect on yield is material. At maximum leverage, looping PT-sUSDe can increase effective yield by more than 9× relative to holding sUSDe without leverage.

Execution complexity used to be a limiting factor. That friction has largely disappeared. Platforms such as Kamino now offer one-click looping, lowering the barrier to entry and increasing system-wide leverage.

6. Yield Comes From Private Credit

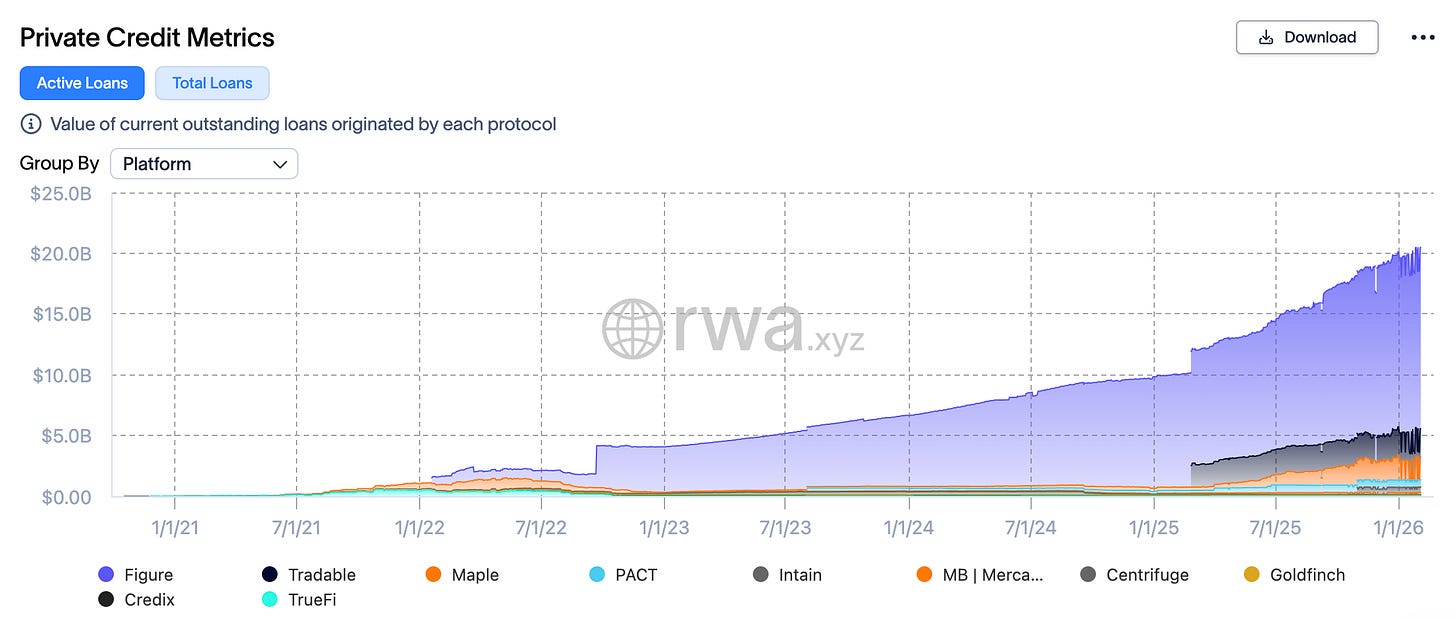

Another growing source of DeFi yield comes from access to private credit markets that were historically difficult, if not impossible, to reach on-chain.

The largest on-chain credit operation today belongs to Figure Technologies, which operates on the Provenance Blockchain. Figure has tokenized assets such as HELOCs and other consumer loans, reaching close to $19 billion in total value originated, with roughly $15 billion active as of early 2026. The yield here comes from traditional private lending economics (credit spreads, borrower demand, and structured underwriting) now made accessible through tokenized rails.

On the institutional side, ACRED has emerged as one of the more visible on-chain private credit feeder funds. ACRED represents tokenized exposure to Apollo Global Management’s Diversified Credit Fund, launched in partnership with Securitize. The underlying fund targets mid-single to low-double-digit returns from private credit. When used as collateral in DeFi lending markets, that yield can be further amplified through looping, pushing effective returns beyond what the underlying credit assets generate on their own.

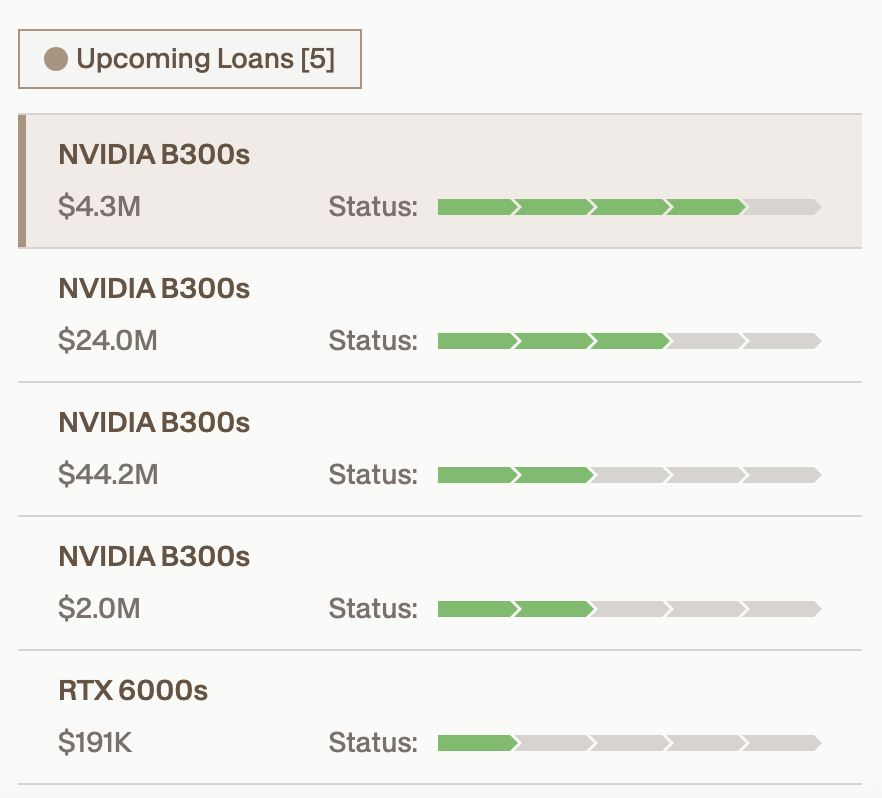

Some private credit strategies push the abstraction even further. USD.AI presents itself as a stablecoin, but functions more like a credit vehicle. It deploys stablecoin reserves into loans backed by tokenized NVIDIA GPUs housed in data centers, tying yield to demand for AI compute infrastructure rather than financial markets. The structure introduces operational and counterparty risk, but it also opens a yield source that has little direct correlation to crypto trading activity.

Across these examples, the common thread is illiquidity and access. Private credit yields exist because capital is locked up, underwriting is non-trivial, and risks are less transparent than in public markets.

7. Yield Comes From Incentives

A meaningful portion of DeFi yield comes from explicit incentive programs rather than organic market demand.

Yield enters the DeFi system through incentives originating at the protocol and stablecoin levels. The distinction between foundational yield and subsidized yield matters, because much of what appears downstream is built on incentives paid upstream.

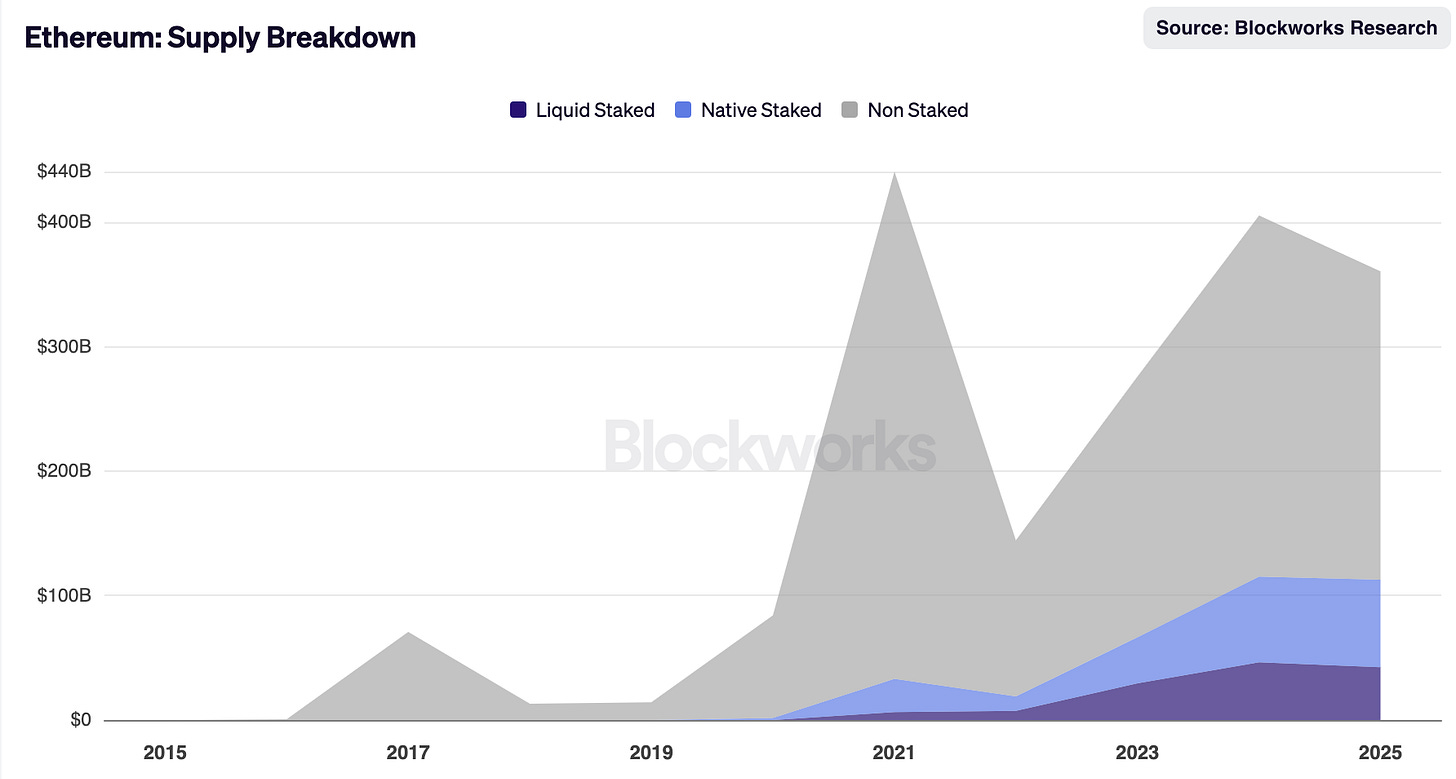

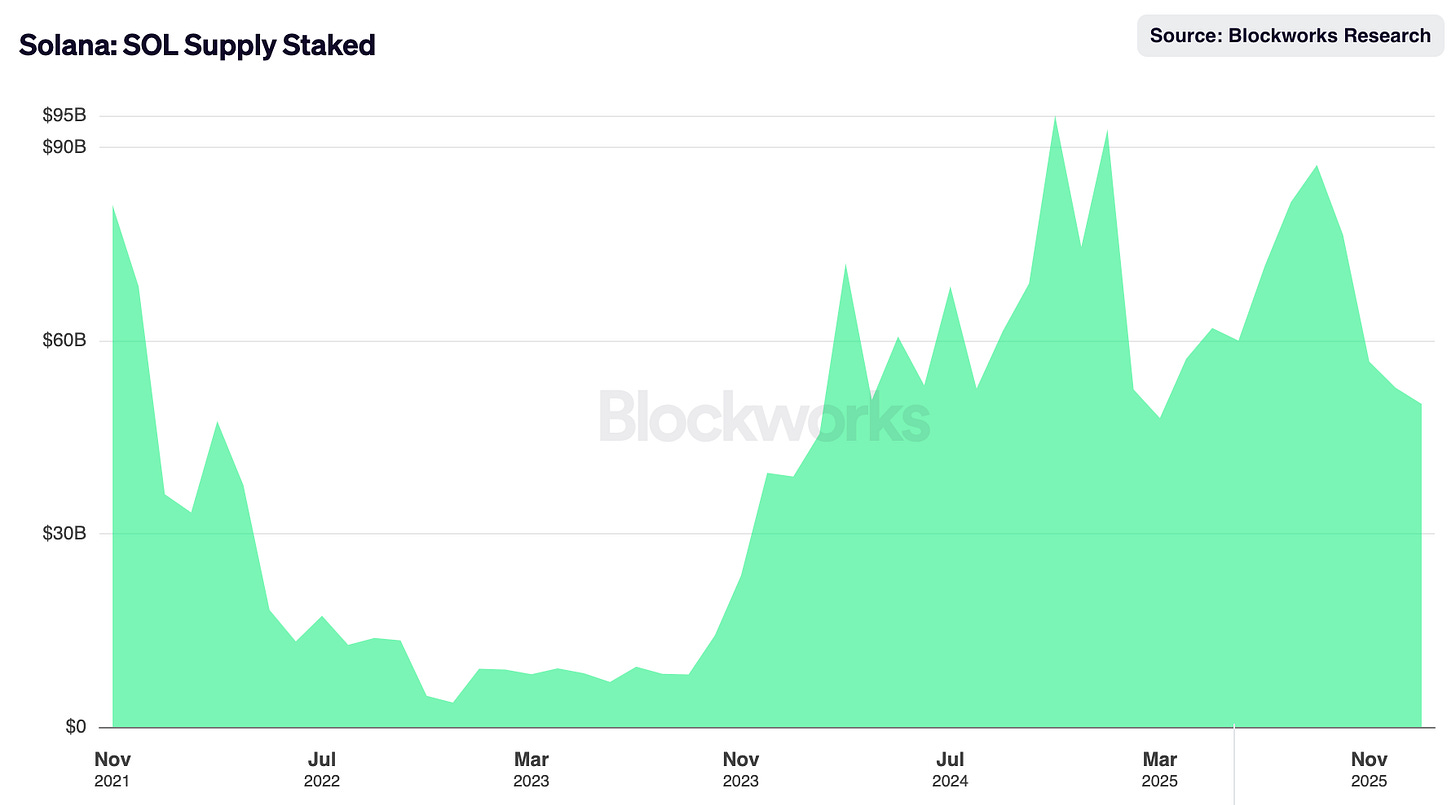

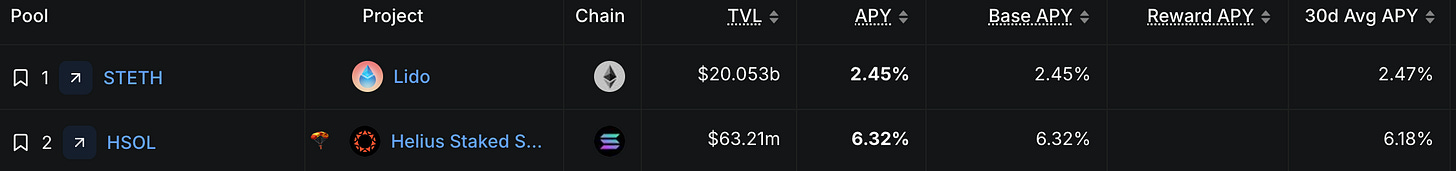

At the base of the stack sit protocol-level rewards. Validator rewards on networks like Ethereum and Solana, alongside liquidity provider rewards on DEXes such as Uniswap, Hyperliquid, and Jupiter, form the foundational layer of yield in DeFi. This yield is paid through inflation, priority fees, and MEV, compensating validators and liquidity providers for securing networks and markets.

Liquid staking tokens such as stETH, now the cornerstone of the DeFi ecosystem, turn these protocol-level incentives into composable financial primitives. Once tokenized, staking yield becomes collateral, margin, and a reusable building block across lending, trading, and structured products.

From there, incentives are recycled downstream.

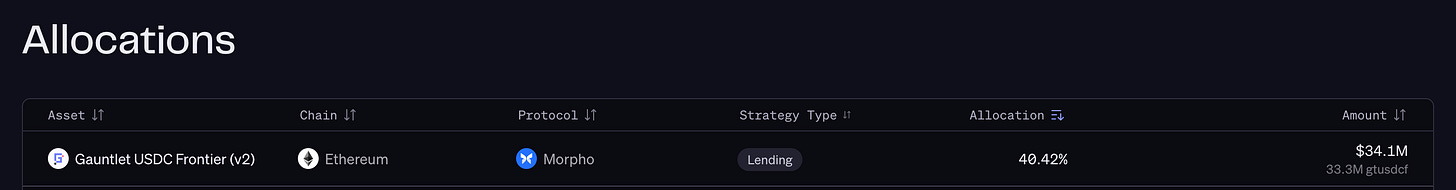

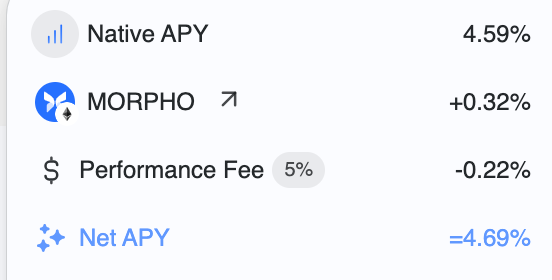

These same protocol incentives, particularly from newer protocols, are often used to subsidize stablecoin and curator yields. A clear example is Gauntlet’s USDC Frontier vault, where roughly 0.32% of the yield comes directly from Morpho incentives layered on top of base lending returns.

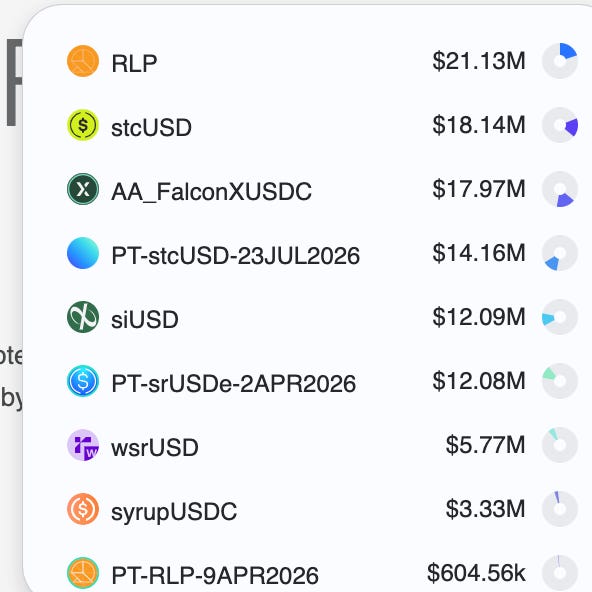

USDC Frontier then allocates capital toward tokens advertising higher risk-adjusted yields, including stcUSD, PT-stcUSD, RLP, and permissioned credit-backed assets such as AA_FalconXUSDC. Borrowers frequently loop these tokens to increase exposure, while Gauntlet supplies USDC under the assumption that these instruments behave as stable collateral.

For several of these assets, yield ultimately traces back to incentive programs rather than underlying economic activity:

stcUSD derives yield from Cap Money’s points program.

PT-stcUSD converts that incentive-driven yield into fixed returns via Pendle.

siUSD operates as a stablecoin–curator hybrid distributing rewards to stakers.

Other assets bundled into these strategies draw yield from mechanisms discussed earlier:

RLP sources yield from delta-neutral trading strategies.

PT-srUSDe relies on delta-neutral positioning.

AA_FalconXUSDC earns yield through private credit exposure.

syrupUSDC ties returns to on-chain private credit markets.

Incentive-driven yield plays a critical role in bootstrapping liquidity and directing capital. It accelerates adoption, but it behaves differently from lending or trading-based yield. Its durability depends on continued emissions, point programs, or external subsidies. When those incentives fade, capital reallocates quickly.

8. Yield Comes From Pseudo “Hedge Funds”

Not all stablecoins are built to behave like money. Some function as wrappers around trading strategies, effectively tokenized shares in relatively stable hedge-fund-like vehicles.

There are more reputable implementations, such as Ethena, but the category as a whole carries real risk. The collapse of Stream Finance made that explicit, and even Ethena has experienced material drawdowns during periods of market stress.

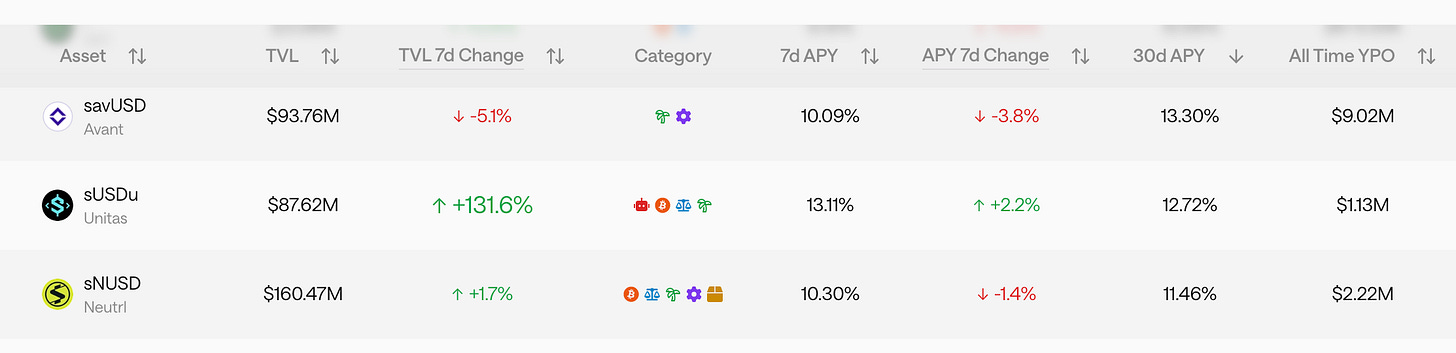

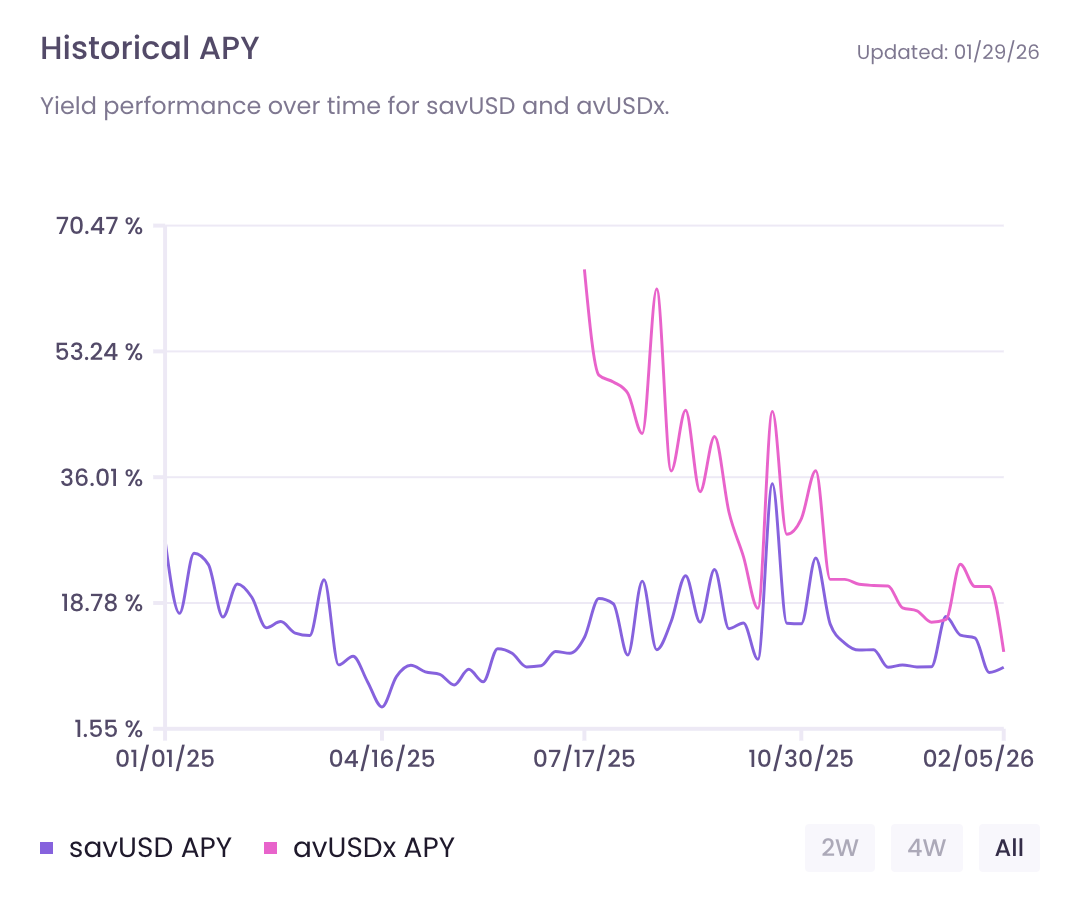

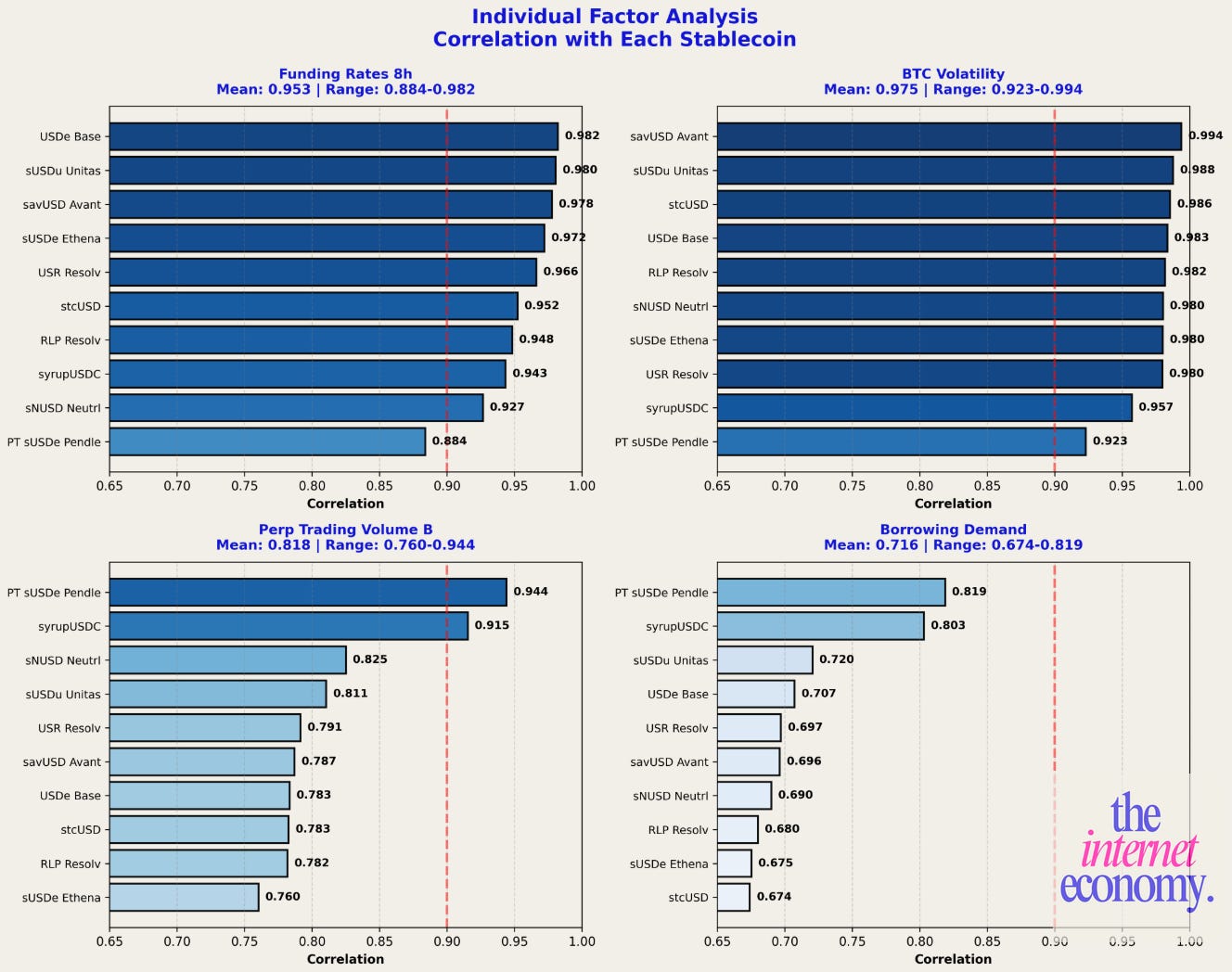

Looking at the highest-yielding stablecoins, a clear pattern emerges. Names like Avant, Unitas, and Neutrl consistently sit near the top of the yield rankings.

Unitas’s sUSDu generates yield through delta-neutral JLP positions, hedging long exposure with short perpetuals.

Avant’s savUSD earns yield through actively managed, market-neutral strategies including basis trades and lending rate arbitrage.

Neutrl’s sNUSD functions as a tokenized hedge-fund-like strategy, capturing alpha by purchasing locked or OTC altcoins at a discount and hedging price exposure with perpetual futures.

Across these products, yields have been volatile and, over time, compressing. Early high returns attract capital, strategies crowd, and marginal returns decline.

In effect, these resemble a more structured evolution of DeFi Summer 2020 yield farming. The strategies are more sophisticated, but the underlying dynamics are familiar. They offer access to yield sources that traditional finance struggles to reach, while introducing distinct risks:

Imperfect hedging, including exposure to auto-deleveraging mechanisms on derivatives venues

Strategy execution failures, including periods where hedges are incomplete or misaligned (e.g. Stream Finance)

Temporary APYs driven by mercenary capital rather than durable demand

Protocols have responded by improving transparency through dashboards detailing asset composition, counterparties, and strategy mechanics. That helps, but it doesn’t eliminate structural risk.

Two pressures are harder to escape. Successful strategies crowd quickly, forcing teams to search for new sources of alpha. At the same time, exchanges increasingly internalize these strategies and offer them directly to users at lower cost. Jupiter’s native delta-neutral JLP product is a clear example. Many high-yield stablecoins rely on the same mechanics without the same distribution or fee advantages.

Calling these products “stablecoins” is debatable, however, packaging fund exposure into a stable wrapper gives users a cleaner unit of risk. For example, if an underlying strategy, expressed through a stablecoin, yields 8%, a holder seeking higher returns (and willing to accept more risk) can loop that position (see Section 5). In some cases, this produces alpha: leveraging a lower-volatility, lower-yield strategy can deliver better risk-adjusted returns than simply allocating to a higher-APY product outright.

What’s being offered here is not free yield, but balance-sheet engineering, increasingly accessible to anyone willing to understand the machinery underneath.

What Can Go Right and What Can Go Wrong

By now, the mechanics are clear. The remaining question is what conditions actually push yields higher and where the system may break.

How Do We Get Higher Rates?

Higher treasury rates → higher base yields passed on to stablecoin holders

Higher trading volumes → higher demand for leverage → higher borrowing costs → higher yields for lenders

More traders losing money → higher profits for counterparties to leveraged perpetuals → higher JLP (Jupiter Liquidity Provider) and HLP (Hyperliquidity Provider) returns → higher APYs for stablecoins sourcing yield from these strategies

Stronger wealth effect (or anticipation of higher BTC prices) → higher unrealized gains → greater borrowing capacity against Bitcoin and other assets → higher cbBTC-backed lending yields

Looser risk parameters → higher loan-to-value ratios → more looping → higher effective yields

Access to private markets (often less liquid and riskier) → illiquidity premium → higher yields

Larger crypto protocol airdrops → higher incentives → increased demand for Pendle YT → higher fixed rates on Pendle PT

Where This Could Go Wrong

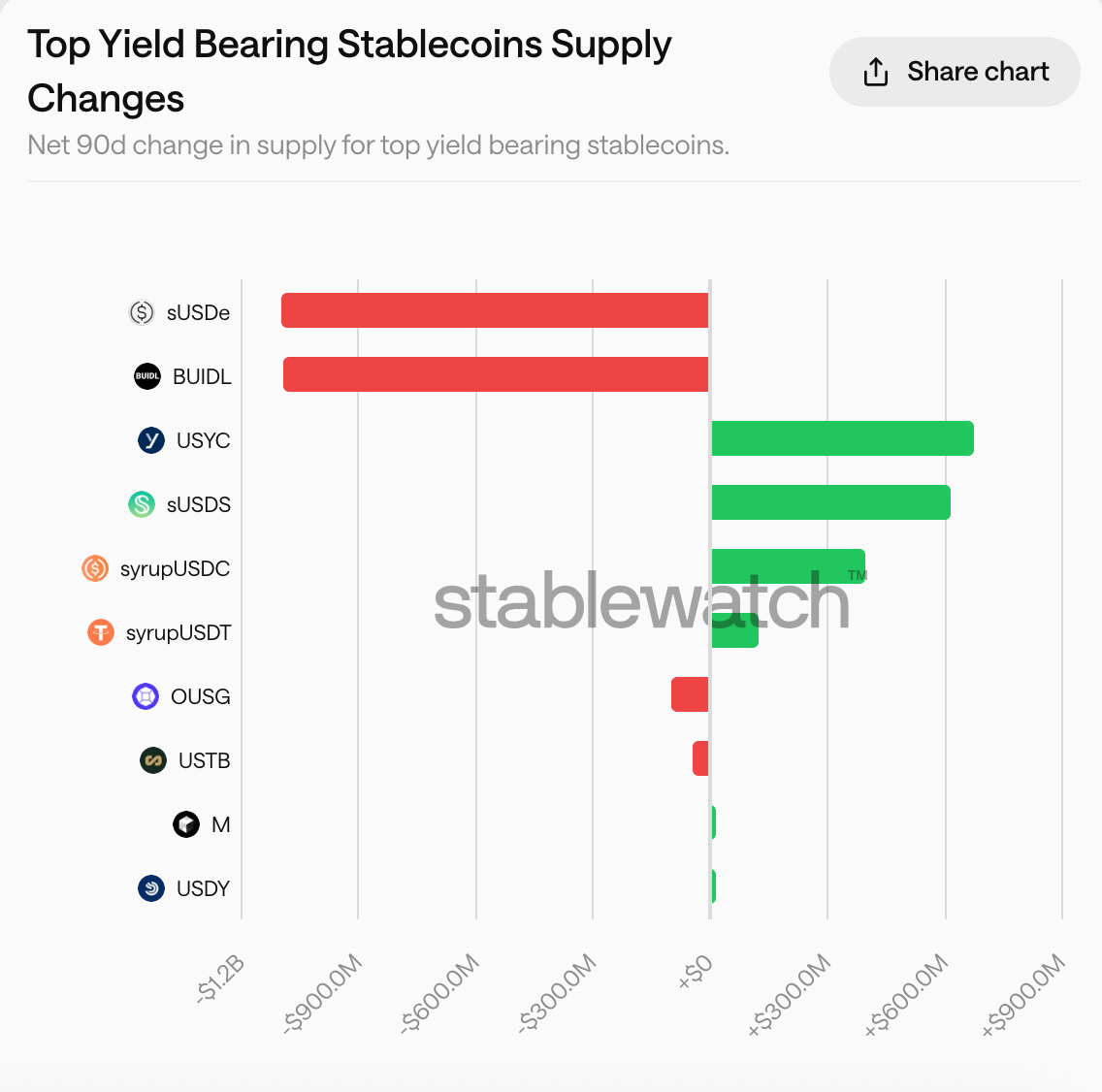

Depeggings, even temporary ones, can force looped positions to unwind. The drawdown experienced by Ethena after October 10th, 2025 is a clear example.

Private credit–backed stablecoins face liquidity mismatches (e.g. 31-day redemption windows) and counterparty risk that is difficult to observe on-chain.

Lower trading volume compresses funding rates, reduces leverage demand, and directly lowers yields tied to trading activity.

Opacity in vault demand makes it difficult to assess risk. In some cases, it’s unclear what share of USDC borrowing comes from independent market participants versus the protocol whose asset is used as collateral (e.g. how much of outstanding stcUSD borrowing originates from the Cap Money ecosystem itself).

Stablecoins as funds in disguise. Many of these structures resemble curators, trading funds, or private credit allocators where the stablecoin represents a claim on a balance sheet. Like earlier generations of crypto allocators, they can fail, triggering losses that ripple back to token holders and connected protocols, as seen with Stream Finance.

Yield competition creates reflexive risk-taking. Protocols that compete primarily on yield become dependent on maintaining that yield to defend TVL. When organic returns fall, the incentive is to move further down the risk curve. Ethena serves as a cautionary example.

Even with unresolved transparency issues, DeFi has introduced financial instruments that, when used correctly, can offer higher risk-adjusted returns than traditional markets. It’s no surprise that Wall Street is eager to gain access.

Conclusion

Most DeFi-native yield still traces back to trading activity.

Whether it shows up as lending to traders, looping, delta-neutral strategies, or pseudo hedge-fund stablecoins, trading volume and leverage remain the primary engines of yield. Even strategies that appear market-neutral ultimately depend on active markets, funding rates, and counterparties taking the other side of risk.

Beyond trading, the remaining drivers of yield fall into three buckets.

Macro conditions set the floor. Treasury pass-through and protocol staking rewards anchor the low-risk end of the spectrum, but on their own they produce modest returns.

Speculation and incentives amplify yield temporarily. Emissions, points programs, and subsidized vaults accelerate adoption and liquidity, but they are inherently transient.

Illiquidity and balance-sheet risk push yields higher. Private credit, structured products, and hedge-fund-like strategies compensate users for locking capital, absorbing volatility, or warehousing tail risk.

What changes outcomes is not the source of yield, but how aggressively it is multiplied.

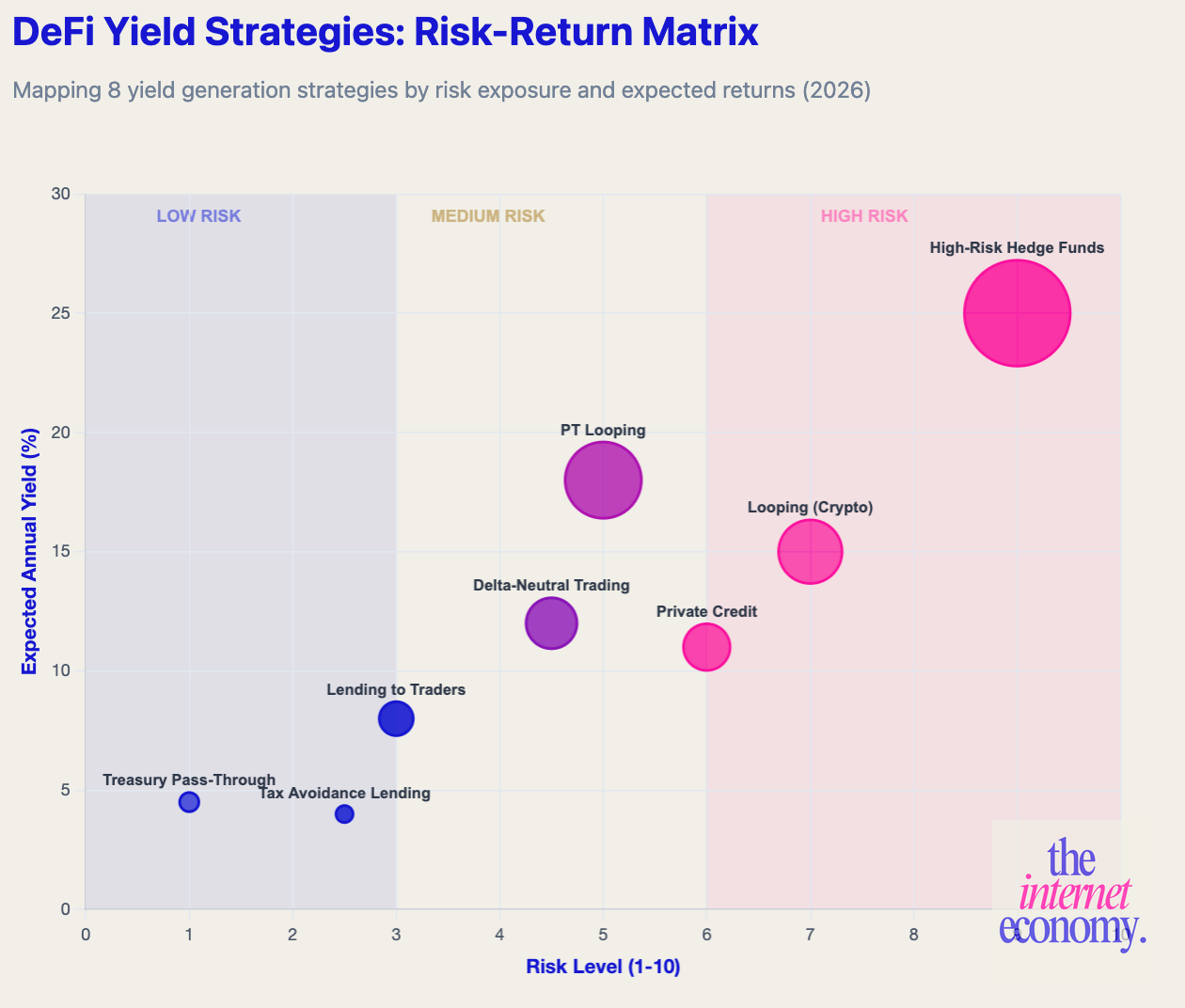

Looping, PT structures, leveraged incentives, and multi-strategy vehicles all increase yield per unit of capital by increasing risk per unit of capital. The charts make this clear: as strategies move up the risk curve, returns rise not because the underlying yield source improves, but because leverage, complexity, and fragility increase.

This is why lower-risk strategies like plain lending, treasury pass-through, and unlevered staking, consistently offer lower returns when used in isolation.

The core insight is this:

DeFi does not create yield out of thin air. It rearranges, amplifies, and repackages risk.

Understanding where yield originates, and how it is multiplied, is the difference between owning an instrument and understanding the machine behind it.

If you’re thinking about these questions, let’s talk.

LinkedIn: https://www.linkedin.com/in/jurgis-pocius/

Email: jurgis@evoaai.com

Join for emerging tech insights from strategy to implementation. Trusted by JPMorgan, McKinsey, HBS, Dior, Nike and leading VC funds and traders. Because after all, Jeff Bezos found the idea for Amazon via a newsletter just like this.